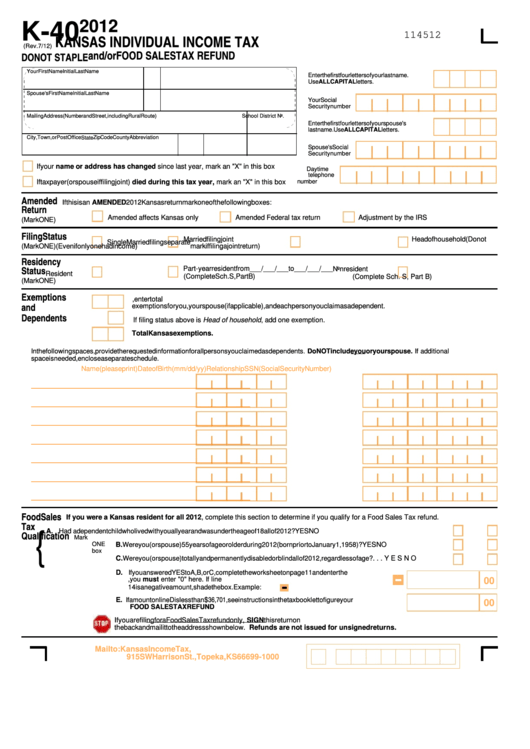

2012

K-40

114512

KANSAS INDIVIDUAL INCOME TAX

(Rev. 7/12)

and/or FOOD SALES TAX REFUND

DO NOT STAPLE

Your First Name

Initial Last Name

Enter the first four letters of your last name.

Use ALL CAPITAL letters.

Spouse's First Name

Initial Last Name

Your Social

Security number

Mailing Address (Number and Street, including Rural Route)

School District No.

Enter the first four letters of your spouse's

last name. Use ALL CAPITAL letters.

City, Town, or Post Office

Zip Code

County Abbreviation

State

Spouse's Social

Security number

If your name or address has changed since last year, mark an "X" in this box

Daytime

telephone

If taxpayer (or spouse if filing joint) died during this tax year, mark an "X" in this box

number

Amended

If this is an AMENDED 2012 Kansas return mark one of the following boxes:

Return

Amended affects Kansas only

Amended Federal tax return

Adjustment by the IRS

(Mark ONE)

Filing Status

Married filing joint

Head of household (Do not

Single

Married filing separate

(Mark ONE)

(Even if only one had income)

mark if filing a joint return)

Residency

Status

Part-year resident from ___ / ___ / ___

to ___ / ___ / ___

Nonresident

Resident

(Complete Sch. S, Part B)

(Complete Sch. S, Part B)

(Mark ONE)

Exemptions

Enter the number of exemptions you claimed on your 2012 federal return. If no federal return is required, enter total

and

exemptions for you, your spouse (if applicable), and each person you claim as a dependent.

Dependents

If filing status above is Head of household, add one exemption.

Total Kansas exemptions.

In the following spaces, provide the requested information for all persons you claimed as dependents. Do NOT include you or your spouse. If additional

space is needed, enclose a separate schedule.

Name (please print)

Date of Birth (mm/dd/yy)

Relationship

SSN (Social Security Number)

________________________________________

________________

________________________________________

________________

________________________________________

________________

________________________________________

________________

________________________________________

________________

________________________________________

________________

________________________________________

________________

Food Sales

If you were a Kansas resident for all 2012, complete this section to determine if you qualify for a Food Sales Tax refund.

Tax

{

A. Had a dependent child who lived with you all year and was under the age of 18 all of 2012?. . . . .

YES

NO

Qualification

Mark

ONE

B. Were you (or spouse) 55 years of age or older during 2012 (born prior to January 1, 1958)? . . . . .

YES

NO

box

C. Were you (or spouse) totally and permanently disabled or blind all of 2012, regardless of age? . . .

YES

NO

D. If you answered YES to A, B, or C, complete the worksheet on page 11 and enter the

QUALIFYING INCOME from line 14. If line 14 is zero, you must enter "0" here. If line

00

14 is a negative amount, shade the box. Example:

E. If amount on line D is less than $36,701 , see instructions in the tax booklet to figure your

00

refund. Enter the amount here. This is your FOOD SALES TAX REFUND. . . . . . . . . . .

If you are filing for a Food Sales Tax refund only, you do not need to complete lines 1 through 40. Just SIGN this return on

the back and mail it to the address shown below. Refunds are not issued for unsigned returns.

Mail to: Kansas Income Tax, Kansas Dept. of Revenue

915 SW Harrison St., Topeka, KS 66699-1000

1

1 2

2