Form K-40 - Kansas Individual Income Tax And/or Food Sales Tax Refund - 2004

ADVERTISEMENT

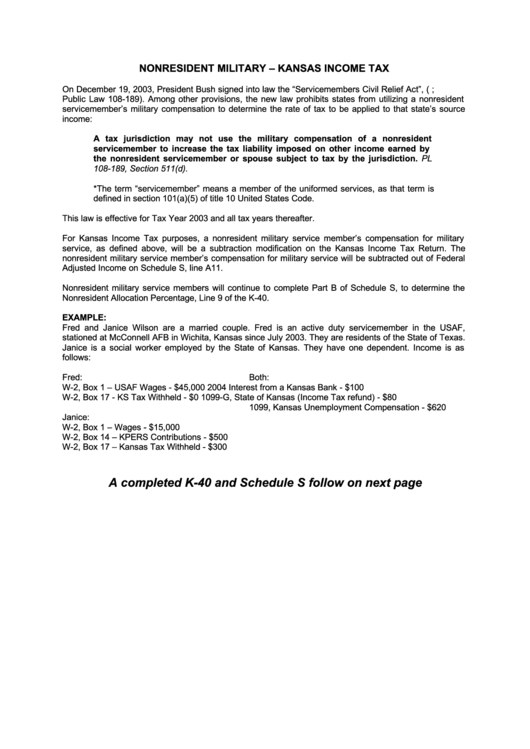

NONRESIDENT MILITARY – KANSAS INCOME TAX

On December 19, 2003, President Bush signed into law the “Servicemembers Civil Relief Act”, (H.B. 100;

Public Law 108-189). Among other provisions, the new law prohibits states from utilizing a nonresident

servicemember’s military compensation to determine the rate of tax to be applied to that state’s source

income:

A tax jurisdiction may not use the military compensation of a nonresident

servicemember to increase the tax liability imposed on other income earned by

the nonresident servicemember or spouse subject to tax by the jurisdiction. PL

108-189, Section 511(d).

*The term “servicemember” means a member of the uniformed services, as that term is

defined in section 101(a)(5) of title 10 United States Code.

This law is effective for Tax Year 2003 and all tax years thereafter.

For Kansas Income Tax purposes, a nonresident military service member’s compensation for military

service, as defined above, will be a subtraction modification on the Kansas Income Tax Return. The

nonresident military service member’s compensation for military service will be subtracted out of Federal

Adjusted Income on Schedule S, line A11.

Nonresident military service members will continue to complete Part B of Schedule S, to determine the

Nonresident Allocation Percentage, Line 9 of the K-40.

EXAMPLE:

Fred and Janice Wilson are a married couple. Fred is an active duty servicemember in the USAF,

stationed at McConnell AFB in Wichita, Kansas since July 2003. They are residents of the State of Texas.

Janice is a social worker employed by the State of Kansas. They have one dependent. Income is as

follows:

Fred:

Both:

W-2, Box 1 – USAF Wages - $45,000

2004 Interest from a Kansas Bank - $100

W-2, Box 17 - KS Tax Withheld - $0

1099-G, State of Kansas (Income Tax refund) - $80

1099, Kansas Unemployment Compensation - $620

Janice:

W-2, Box 1 – Wages - $15,000

W-2, Box 14 – KPERS Contributions - $500

W-2, Box 17 – Kansas Tax Withheld - $300

A completed K-40 and Schedule S follow on next page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5