090002E1

Alabama ET-1 – 2009

Page 2

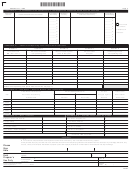

SCHEDULE A – IN ACCORDANCE WITH SECTION 40-16-6, THE INFORMATION REQUESTED BELOW MUST BE PROVIDED

Department

Percentage In

Department

Municipalities In Which Business Is

Percentage In

Counties In Which Business Is Conducted

Use Only

Each County

Use Only

Conducted In Each County

Each Municipality

________%

________%

________%

________%

________%

________%

Check here

________%

________%

if no office is

________%

________%

maintained in

________%

________%

this state.

________%

________%

________%

________%

________%

________%

________%

________%

SCHEDULE B – Alabama Net Operating Loss Carryforward Calculation

Column 1

Column 2

Column 3

Column 4

Column 5

Loss Year End

Amount of Alabama

Amount used in years

Amount used

Remaining unused

MM / DD / YYYY

net operating loss

prior to this year

this year

net operating loss

•

•

•

•

•

•

•

•

•

•

•

•

Alabama net operating loss (enter here and on line 30, page 1).

SCHEDULE D – Bad Debts – Reserve Method (See Instructions)

Trade Notes And Accounts

Amount Added To Reserve

Amount

Reserve For

Year

Receivable Outstanding

Current Year’s

Charged Against

Bad Debts At

At End of Year

Provision

Recoveries

Reserve

End of Year

•

2003

•

2004

•

2005

•

2006

•

2007

•

SCHEDULE E – Taxes Deducted

SCHEDULE F – Alabama Taxes Used As Credits

2008

•

•

Franchise Taxes and Permits

Sales Taxes: Supplies, etc.

•

•

Privilege Taxes

Furniture, Fixtures

•

•

Social Security Taxes

Use Taxes

•

•

Ad Valorem Taxes

State Tax on Utilities

•

•

Other Taxes – Attach Schedule

State Tax on Telephone

•

•

TOTAL TO LINE 12, PAGE 1 . . . . . . . . . . . . . .

Other Allowable Credits

•

AFFIDAVIT

TOTAL TO LINE 33, PAGE 1 . . . . . . . . . . . . . .

•

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief, they

are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

Sign

Here

Your signature

Date

Title or Position

Preparer’s

Date

Preparer’s Social Security No.

Paid

•

•

signature

Preparer’s

•

•

Firm’s name (or yours

E.I. No.

if self-employed)

Use Only

•

•

ZIP Code

and address

Person to contact for information

Telephone

• (

)

concerning this return . . . . . . . . . . . . . . . . . . . . . . . . Name

Number

ADOR

1

1 2

2 3

3 4

4