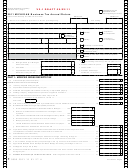

Form 4567, Page 2

FEIN or TR Number

PART 2: BUSINESS INCOME TAX (Cont.)

25. Subtractions From Income. (See instructions.)

a. Dividends and royalties received from persons other than United

00

States persons and foreign operating entities ............................................

25a.

00

b. Income attributable to other taxable flow-through entities ..........................

25b.

Account No.

00

c. Interest income derived from United States obligations .............................

25c.

00

d. Net earnings from self-employment. If less than zero, enter zero .............

25d.

26. Total subtractions from income. Add lines 25a through 25d ................................................................................

26.

00

00

27.

a. Business Income Tax Base. Subtract line 26 from line 24 .......................... 27a.

00

b. If box 10e checked, multiply line 27a by percentage on line 10h. All others, enter amount from line 27a ........ 27b.

00

28. Apportioned Business Income Tax Base. Multiply line 27b by percentage on line 10d .........................................

28.

00

29. Available MBT business loss carryforward from previous MBT return. Enter as a positive number......................

29.

30. a. Subtract line 29 from line 28. If negative, enter here as a negative number and skip to line 31. This is the

00

available business loss carryforward to the next filing period (see instructions). Otherwise, go to line 30b .... 30a.

00

b. If line 30a is positive, enter the qualified affordable housing deduction (see instructions) ................................ 30b.

00

c. Subtract line 30b from line 30a. If less than zero, enter zero. ........................................................................... 30c.

31. Business Income Tax Before All Credits. Multiply line 30a or 30c, whichever applies, by 4.95% (0.0495).

00

If less than zero, enter zero ......................................................................................................................................

31.

PART 3: TOTAL MICHIGAN BUSINESS TAX

00

32. Total Michigan Business Tax Before Surcharge and Credits. Add lines 20 and 31 .......................................

32.

00

33. Annual Surcharge. Enter the lesser of $6,000,000 or line 32 multiplied by 21.99% (0.2199) ...............................

33.

00

34. Total Liability Before All Credits. Add lines 32 and 33 .......................................................................................

34.

00

35. Nonrefundable credits from Form 4568, line 37 ....................................................................................................

35.

00

36. Total Tax After Nonrefundable Credits. Subtract line 35 from line 34. If less than zero, enter zero ................

36.

00

37. Recapture of Certain Business Tax Credits and Deductions from Form 4587, line 10 ..........................................

37.

00

38. Total Tax Liability. Add lines 36 and 37 ...............................................................................................................

38.

PART 4: PAYMENTS, REFUNDABLE CREDITS AND TAX DUE

00

39. Overpayment credited from prior return (SBT or MBT) ...................................

39.

00

40. Estimated tax payments ..................................................................................

40.

00

41. Tax paid with request for extension .................................................................

41.

00

42. Refundable credits from Form 4574, line 23 ...................................................

42.

43. Total. Add lines 39 through 42. (Then, if not amending, skip to line 45.) ..............................................................

43.

00

a. Payment made with the original return ................................. 44a.

00

AMENDED

44.

b. Overpayment received on the original return ....................... 44b.

RETURN

00

ONLY

c. Add lines 43 and 44a and subtract line 44b from the sum ... ...................................................

44c.

00

00

45. TAX DUE. Subtract line 43 (or line 44c, if amending) from line 38. If zero or less than zero, leave blank ............

45.

00

46. Underpaid estimate penalty and interest from Form 4582, line 38 ........................................................................

46.

% =

00

00

00

47. Annual return penalty

plus interest of

. Enter total ....

47.

00

48. PAYMENT DUE. If line 45 is blank, go to line 49. Otherwise, add lines 45 through 47 .......................................

48.

PART 5: REFUND OR CREDIT FORWARD

49. Overpayment. Subtract lines 38, 46 and 47 from line 43 (or line 44c, if amending). If less than zero, leave

00

49.

blank. (See instructions.) ......................................................................................................................................

00

50. CREDIT FORWARD. Amount of overpayment on line 49 to be credited forward .................................................

50.

00

51. REFUND. Amount of overpayment on line 49 to be refunded ...............................................................................

51.

Taxpayer Certification.

Preparer Certification.

I declare under penalty of perjury that the information in this

I declare under penalty of perjury that this

return and attachments is true and complete to the best of my knowledge.

return is based on all information of which I have any knowledge.

Preparer’s PTIN, FEIN or SSN

By checking this box, I authorize Treasury to discuss my return with my preparer.

Taxpayer Signature

Preparer’s Business Name (print or type)

Taxpayer Name (print or type)

Date

Preparer’s Business Address and Telephone Number (print or type)

Title

Telephone Number

Return is due April 30 or on or before the last day of the 4th month after the close of the tax year.

WITH PAYMENT. Pay amount on line 48. Mail check and return to:

WITHOUT PAYMENT. Mail return to:

Michigan Department of Treasury, P.O. Box 30783, Lansing, MI 48909

Michigan Department of Treasury, P.O. Box 30113, Lansing, MI 48909

Make check payable to “State of Michigan.” Print the FEIN or TR Number

+

and “MBT” on the front of the check. Do not staple the check to the return.

0000 2008 11 02 27 9

1

1 2

2