Estimated Taxpayment Form - City Of Brook Park - Department Of Taxation

ADVERTISEMENT

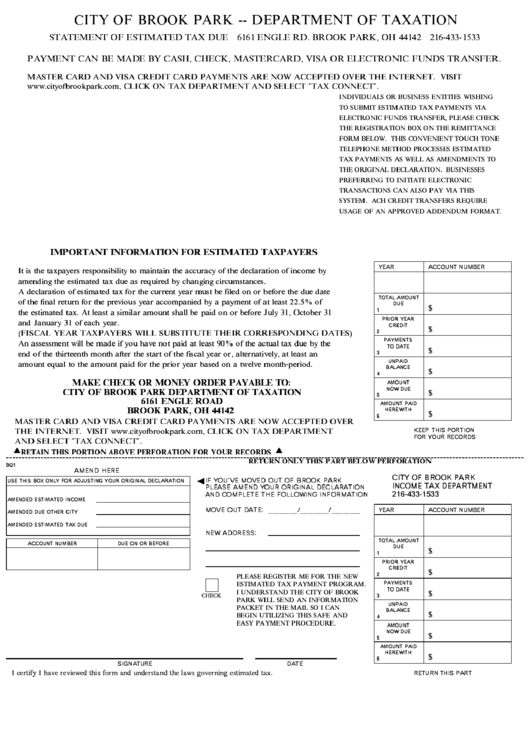

CITY OF BROOK PARK -- DEPARTMENT OF TAXATION

STATEMENT OF ESTIMATED TAX DUE 6161 ENGLE RD. BROOK PARK, OH 44142 216-433-1533

PAYMENT CAN BE MADE BY CASH, CHECK, MASTERCARD, VISA OR ELECTRONIC FUNDS TRANSFER.

MASTER CARD AND VISA CREDIT CARD PAYMENTS ARE NOW ACCEPTED OVER THE INTERNET. VISIT

, CLICK ON TAX DEPARTMENT AND SELECT "TAX CONNECT".

INDIVIDUALS OR BUSINESS ENTITIES WISHING

TO SUBMIT ESTIMATED TAX PAYMENTS VIA

ELECTRONIC FUNDS TRANSFER, PLEASE CHECK

THE REGISTRATION BOX ON THE REMITTANCE

FORM BELOW. THIS CONVENIENT TOUCH TONE

TELEPHONE METHOD PROCESSES ESTIMATED

TAX PAYMENTS AS WELL AS AMENDMENTS TO

THE ORIGINAL DECLARATION. BUSINESSES

PREFERRING TO INITIATE ELECTRONIC

TRANSACTIONS CAN ALSO PAY VIA THIS

SYSTEM. ACH CREDIT TRANSFERS REQUIRE

USAGE OF AN APPROVED ADDENDUM FORMAT.

IMPORTANT INFORMATION FOR ESTIMATED TAXPAYERS

YEAR

ACCOUNT NUMBER

It is the taxpayers responsibility to maintain the accuracy of the declaration of income by

amending the estimated tax due as required by changing circumstances.

A declaration of estimated tax for the current year must be filed on or before the due date

TOTAL AMOUNT

of the final return for the previous year accompanied by a payment of at least 22.5% of

DUE

$

the estimated tax. At least a similar amount shall be paid on or before July 31, October 31

1

PRIOR YEAR

and January 31 of each year.

CREDIT

$

(FISCAL YEAR TAXPAYERS WILL SUBSTITUTE THEIR CORRESPONDING DATES)

2

PAYMENTS

An assessment will be made if you have not paid at least 90% of the actual tax due by the

TO DATE

$

end of the thirteenth month after the start of the fiscal year or, alternatively, at least an

3

amount equal to the amount paid for the prior year based on a twelve month-period.

UNPAID

BALANCE

$

4

MAKE CHECK OR MONEY ORDER PAYABLE TO:

AMOUNT

CITY OF BROOK PARK DEPARTMENT OF TAXATION

NOW DUE

$

5

6161 ENGLE ROAD

AMOUNT PAID

BROOK PARK, OH 44142

HEREWITH

$

6

MASTER CARD AND VISA CREDIT CARD PAYMENTS ARE NOW ACCEPTED OVER

THE INTERNET. VISIT , CLICK ON TAX DEPARTMENT

KEEP THIS PORTION

FOR YOUR RECORDS

AND SELECT "TAX CONNECT".

RETAIN THIS PORTION ABOVE PERFORATION FOR YOUR RECORDS

RETURN ONLY THIS PART BELOW PERFORATION

BQ1

AMEND HERE

CITY OF BROOK PARK

IF YOUVE MOVED OUT OF BROOK PARK

USE THIS BOX ONLY FOR ADJUSTING YOUR ORIGINAL DECLARATION

INCOME TAX DEPARTMENT

PLEASE AMEND YOUR ORIGINAL DECLARATION

216-433-1533

AND COMPLETE THE FOLLOWING INFORMATION

AMENDED ESTIMATED INCOME

MOVE OUT DATE: ________/________/________

YEAR

ACCOUNT NUMBER

AMENDED DUE OTHER CITY

AMENDED ESTIMATED TAX DUE

NEW ADDRESS:

TOTAL AMOUNT

ACCOUNT NUMBER

DUE ON OR BEFORE

DUE

$

1

PRIOR YEAR

CREDIT

$

PLEASE REGISTER ME FOR THE NEW

2

ESTIMATED TAX PAYMENT PROGRAM.

PAYMENTS

TO DATE

I UNDERSTAND THE CITY OF BROOK

$

CHECK

3

PARK WILL SEND AN INFORMATION

UNPAID

PACKET IN THE MAIL SO I CAN

BALANCE

$

BEGIN UTILIZING THIS SAFE AND

4

EASY PAYMENT PROCEDURE.

AMOUNT

NOW DUE

$

5

AMOUNT PAID

HEREWITH

$

6

SIGNATURE

DATE

I certify I have reviewed this form and understand the laws governing estimated tax.

RETURN THIS PART

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1