Reset Form

Michigan Department of Treasury

4132 (Rev. 1-08)

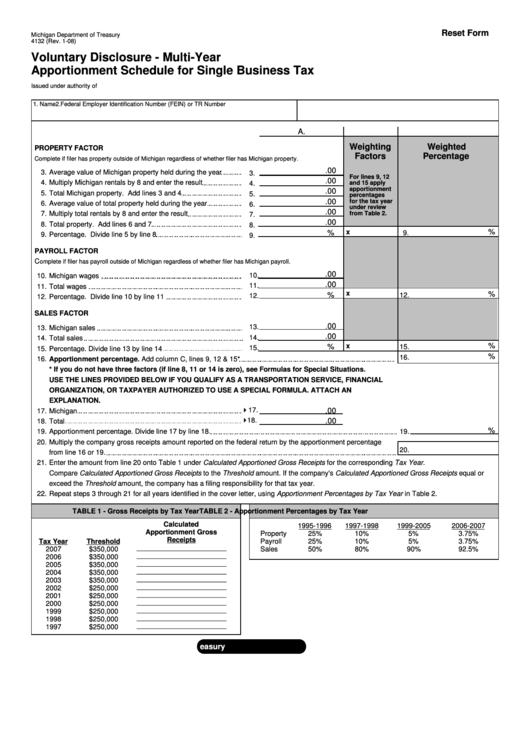

Voluntary Disclosure - Multi-Year

Apportionment Schedule for Single Business Tax

Issued under authority of P.A. 228 of 1975.

1. Name

2. Federal Employer Identification Number (FEIN) or TR Number

A.

B.

C.

Weighting

Weighted

PROPERTY FACTOR

Factors

Percentage

Complete if filer has property outside of Michigan regardless of whether filer has Michigan property.

.00

3.

Average value of Michigan property held during the year

3.

For lines 9, 12

.00

4.

Multiply Michigan rentals by 8 and enter the result

and 15 apply

4.

apportionment

.00

5.

Total Michigan property. Add lines 3 and 4

5.

percentages

.00

for the tax year

6.

Average value of total property held during the year

6.

under review

.00

from Table 2.

7.

Multiply total rentals by 8 and enter the result

7.

.00

8.

Total property. Add lines 6 and 7

8.

%

x

%

9.

9.

Percentage. Divide line 5 by line 8

9.

PAYROLL FACTOR

C

omplete if filer has payroll outside of Michigan regardless of whether filer has Michigan payroll.

.00

10.

10.

Michigan wages

.00

11.

11.

Total wages

x

%

%

12.

12.

12.

Percentage. Divide line 10 by line 11

SALES FACTOR

.00

13.

13.

Michigan sales

.00

14.

14.

Total sales

%

%

x

15.

15.

15.

Percentage. Divide line 13 by line 14

%

16.

16.

Apportionment percentage. Add column C, lines 9, 12 & 15*

* If you do not have three factors (if line 8, 11 or 14 is zero), see Formulas for Special Situations.

USE THE LINES PROVIDED BELOW IF YOU QUALIFY AS A TRANSPORTATION SERVICE, FINANCIAL

ORGANIZATION, OR TAXPAYER AUTHORIZED TO USE A SPECIAL FORMULA. ATTACH AN

EXPLANATION.

17.

.00

17.

Michigan

18.

.00

18.

Total

%

19.

Apportionment percentage. Divide line 17 by line 18.

19.

20.

Multiply the company gross receipts amount reported on the federal return by the apportionment percentage

20.

from line 16 or 19.

21.

Enter the amount from line 20 onto Table 1 under Calculated Apportioned Gross Receipts for the corresponding Tax Year.

Compare Calculated Apportioned Gross Receipts to the Threshold amount. If the company's Calculated Apportioned Gross Receipts equal or

exceed the Threshold amount, the company has a filing responsibility for that tax year.

22.

Repeat steps 3 through 21 for all years identified in the cover letter, using Apportionment Percentages by Tax Year in Table 2.

TABLE 1 - Gross Receipts by Tax Year

TABLE 2 - Apportionment Percentages by Tax Year

Calculated

1995-1996

1997-1998

1999-2005

2006-2007

Apportionment Gross

Property

25%

10%

5%

3.75%

Receipts

Tax Year

Threshold

Payroll

25%

10%

5%

3.75%

_______________________

2007

$350,000

Sales

50%

80%

90%

92.5%

_______________________

2006

$350,000

_______________________

2005

$350,000

_______________________

2004

$350,000

_______________________

2003

$350,000

_______________________

2002

$250,000

_______________________

2001

$250,000

_______________________

2000

$250,000

_______________________

1999

$250,000

_______________________

1998

$250,000

_______________________

1997

$250,000

1

1 2

2 3

3 4

4