Form Il-941 - Illinois Quarterly Withholding Income Tax Return And Instructions - 2005

ADVERTISEMENT

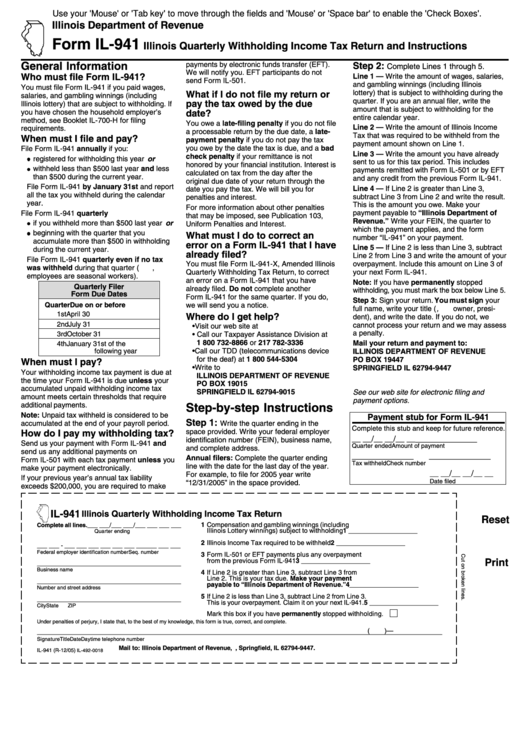

Use your 'Mouse' or 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the 'Check Boxes'.

Illinois Department of Revenue

Form IL-941

Illinois Quarterly Withholding Income Tax Return and Instructions

payments by electronic funds transfer (EFT).

General Information

Step 2:

Complete Lines 1 through 5.

We will notify you. EFT participants do not

Who must file Form IL-941?

Line 1 — Write the amount of wages, salaries,

send Form IL-501.

and gambling winnings (including Illinois

You must file Form IL-941 if you paid wages,

lottery) that is subject to withholding during the

What if I do not file my return or

salaries, and gambling winnings (including

quarter. If you are an annual filer, write the

pay the tax owed by the due

Illinois lottery) that are subject to withholding. If

amount that is subject to withholding for the

you have chosen the household employer’s

date?

entire calendar year.

method, see Booklet IL-700-H for filing

You owe a late-filing penalty if you do not file

Line 2 — Write the amount of Illinois Income

requirements.

a processable return by the due date, a late-

Tax that was required to be withheld from the

When must I file and pay?

payment penalty if you do not pay the tax

payment amount shown on Line 1.

you owe by the date the tax is due, and a bad

File Form IL-941 annually if you:

Line 3 — Write the amount you have already

check penalty if your remittance is not

registered for withholding this year or

sent to us for this tax period. This includes

honored by your financial institution. Interest is

withheld less than $500 last year and less

payments remitted with Form IL-501 or by EFT

calculated on tax from the day after the

than $500 during the current year.

and any credit from the previous Form IL-941.

original due date of your return through the

File Form IL-941 by January 31st and report

Line 4 — If Line 2 is greater than Line 3,

date you pay the tax. We will bill you for

all the tax you withheld during the calendar

subtract Line 3 from Line 2 and write the result.

penalties and interest.

year.

This is the amount you owe. Make your

For more information about other penalties

File Form IL-941 quarterly

payment payable to “Illinois Department of

that may be imposed, see Publication 103,

Revenue.” Write your FEIN, the quarter to

if you withheld more than $500 last year or

Uniform Penalties and Interest.

which the payment applies, and the form

beginning with the quarter that you

What must I do to correct an

number “IL-941” on your payment.

accumulate more than $500 in withholding

error on a Form IL-941 that I have

Line 5 — If Line 2 is less than Line 3, subtract

during the current year.

already filed?

Line 2 from Line 3 and write the amount of your

File Form IL-941 quarterly even if no tax

You must file Form IL-941-X, Amended Illinois

overpayment. Include this amount on Line 3 of

was withheld during that quarter ( e.g. ,

Quarterly Withholding Tax Return, to correct

your next Form IL-941.

employees are seasonal workers).

an error on a Form IL-941 that you have

Note: If you have permanently stopped

Quarterly Filer

already filed. Do not complete another

withholding, you must mark the box below Line 5.

Form Due Dates

Form IL-941 for the same quarter. If you do,

Step 3: Sign your return. You must sign your

Quarter

Due on or before

we will send you a notice.

full name, write your title ( e.g., owner, presi-

1st

April 30

Where do I get help?

dent), and write the date. If you do not, we

2nd

July 31

cannot process your return and we may assess

• Visit our web site at tax.illinois.gov

a penalty.

3rd

October 31

• Call our Taxpayer Assistance Division at

1 800 732-8866 or 217 782-3336

Mail your return and payment to:

4th

January 31st of the

following year

• Call our TDD (telecommunications device

ILLINOIS DEPARTMENT OF REVENUE

for the deaf) at 1 800 544-5304

PO BOX 19447

When must I pay?

• Write to

SPRINGFIELD IL 62794-9447

Your withholding income tax payment is due at

ILLINOIS DEPARTMENT OF REVENUE

the time your Form IL-941 is due unless your

PO BOX 19015

accumulated unpaid withholding income tax

SPRINGFIELD IL 62794-9015

See our web site for electronic filing and

amount meets certain thresholds that require

payment options.

additional payments.

Step-by-step Instructions

Note: Unpaid tax withheld is considered to be

Payment stub for Form IL-941

Step 1:

accumulated at the end of your payroll period.

Write the quarter ending in the

Complete this stub and keep for future reference.

space provided. Write your federal employer

How do I pay my withholding tax?

_____________

__ __/__ __/__ __

identification number (FEIN), business name,

Send us your payment with Form IL-941 and

Quarter ended

Amount of payment

and complete address.

send us any additional payments on

_____________

_____________

Annual filers: Complete the quarter ending

Form IL-501 with each tax payment unless you

Tax withheld

Check number

line with the date for the last day of the year.

make your payment electronically.

__ __/__ __/__ __

For example, to file for 2005 year write

If your previous year’s annual tax liability

Date filed

“12/31/2005” in the space provided.

exceeds $200,000, you are required to make

IL-941

Illinois Quarterly Withholding Income Tax Return

Reset

___ ___/___ ___/___ ___ ___ ___

1 Compensation and gambling winnings (including

Complete all lines.

Illinois Lottery winnings) subject to withholding

1 ___________________

Quarter ending

2 Illinois Income Tax required to be withheld

2 ___________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ ___

Federal employer identification number

Seq. number

3 Form IL-501 or EFT payments plus any overpayment

from the previous Form IL-941

3 ___________________

Print

_________________________________________

Business name

4 If Line 2 is greater than Line 3, subtract Line 3 from

Line 2. This is your tax due. Make your payment

_________________________________________

payable to “Illinois Department of Revenue.”

4 ___________________

Number and street address

5 If Line 2 is less than Line 3, subtract Line 2 from Line 3.

_________________________________________

This is your overpayment. Claim it on your next IL-941. 5 ___________________

City

State

ZIP

Mark this box if you have permanently stopped withholding.

Under penalties of perjury, I state that, to the best of my knowledge, this form is true, correct, and complete.

(

)

—

_______________________________________________________________________________________________________________________

Signature

Title

Date

Daytime telephone number

Mail to: Illinois Department of Revenue, P.O. Box 19447, Springfield, IL 62794-9447.

IL-941 (R-12/05)

IL-492-0018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1