Form Au-330 - Controlling Interest Transfer Taxes Page 3

ADVERTISEMENT

Name of transferor: ________________________________________ Transferor’s CT Tax Registration Number: _____________________Date of transfer: ______________

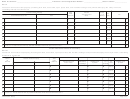

Part VII

Connecticut farm land, forest land, open space land, and maritime heritage land owned directly by the entity in which a controlling interest was transferred.

See instructions for applicable rate.

Type of Land

Location of Real Property

Present

Tax

Town

Date Acquired

F

Tax

= Farm or Forest Land

Code

True and Actual

Rate

or Classifi ed

(Table B)

Value

(Table A)

O

= Open Space or Maritime

Street Address

Town

Heritage Land

1

00

2

00

3

00

4

00

5

Total tax:

Enter here and on Part IV, Line 3.

00

Attach additional sheets if necessary.

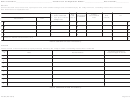

Part VIII

Direct owners of Connecticut real property indirectly owned by the entity in which a controlling interest was transferred

Owner

Social Security Number or

Name

Business Address

Federal Employer ID Number

ID

1

2

3

4

5

6

7

8

Attach additional sheets if necessary.

AU-330 (Rev. 08/10)

Page 3 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3