Contracting Tax Factoring Worksheet - Arizona Department Of Revenue

ADVERTISEMENT

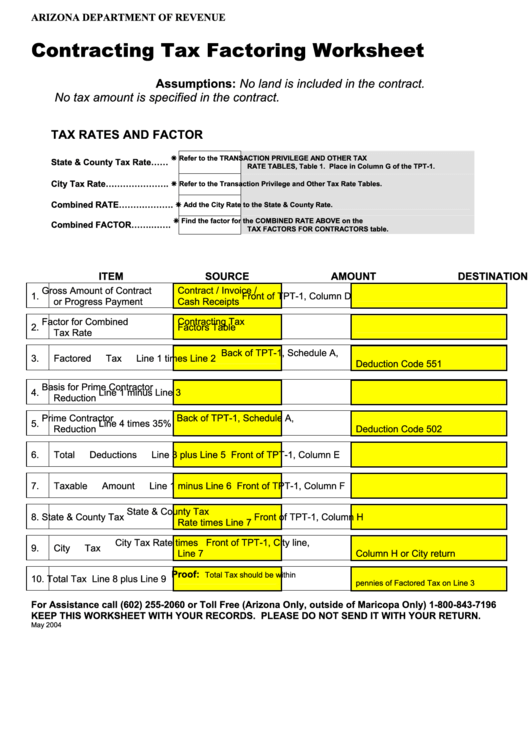

ARIZONA DEPARTMENT OF REVENUE

Contracting Tax Factoring Worksheet

Assumptions:

No land is included in the contract.

No tax amount is specified in the contract.

TAX RATES AND FACTOR

Refer to the TRANSACTION PRIVILEGE AND OTHER TAX

State & County Tax Rate……

RATE TABLES, Table 1. Place in Column G of the TPT-1.

City Tax Rate………………….

Refer to the Transaction Privilege and Other Tax Rate Tables.

Combined RATE……………….

Add the City Rate to the State & County Rate.

Find the factor for the COMBINED RATE ABOVE on the

Combined FACTOR…….…….

TAX FACTORS FOR CONTRACTORS table.

ITEM

SOURCE

AMOUNT

DESTINATION

Gross Amount of Contract

Contract / Invoice /

1.

Front of TPT-1, Column D

or Progress Payment

Cash Receipts

Factor for Combined

Contracting Tax

2.

Tax Rate

Factors Table

Back of TPT-1, Schedule A,

3.

Factored Tax

Line 1 times Line 2

Deduction Code 551

Basis for Prime Contractor

4.

Line 1 minus Line 3

Reduction

Prime Contractor

Back of TPT-1, Schedule A,

5.

Line 4 times 35%

Reduction

Deduction Code 502

6.

Total Deductions

Line 3 plus Line 5

Front of TPT-1, Column E

7.

Taxable Amount

Line 1 minus Line 6

Front of TPT-1, Column F

State & County Tax

8.

State & County Tax

Front of TPT-1, Column H

Rate times Line 7

City Tax Rate times

Front of TPT-1, City line,

9.

City Tax

Line 7

Column H or City return

Proof:

Total Tax should be within

10. Total Tax

Line 8 plus Line 9

pennies of Factored Tax on Line 3

For Assistance call (602) 255-2060 or Toll Free (Arizona Only, outside of Maricopa Only) 1-800-843-7196

KEEP THIS WORKSHEET WITH YOUR RECORDS. PLEASE DO NOT SEND IT WITH YOUR RETURN.

May 2004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4