Print

Clear

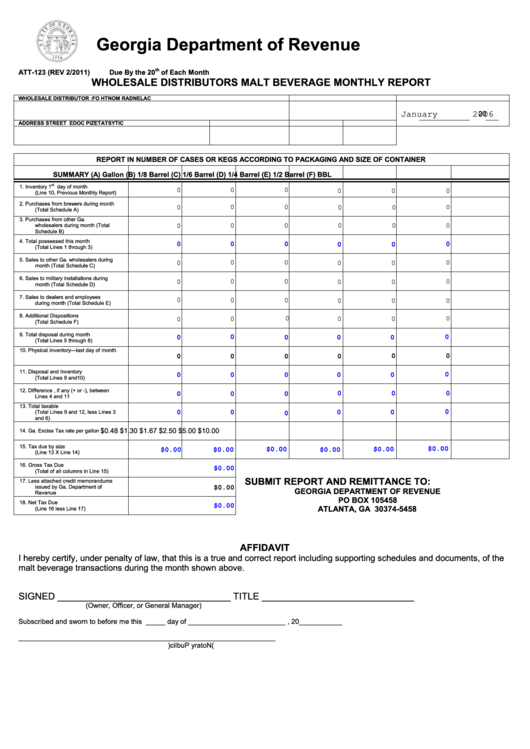

Georgia Department of Revenue

th

ATT-123 (REV 2/2011)

Due By the 20

of Each Month

WHOLESALE DISTRIBUTORS MALT BEVERAGE MONTHLY REPORT

WHOLESALE DISTRIBUTOR

S

T

A

T

E

L

C I

E

N

S

E

N

O

.

F

O

R

C

A

L

E

N

D

A

R

M

O

N

T

H

O

: F

20

January

2006

ADDRESS

STREET

C

T I

Y

S

T

A

T

E

Z

P I

C

O

D

E

REPORT IN NUMBER OF CASES OR KEGS ACCORDING TO PACKAGING AND SIZE OF CONTAINER

SUMMARY

(A) Gallon

(B) 1/8 Barrel

(C) 1/6 Barrel

(D) 1/4 Barrel

(E) 1/2 Barrel

(F) BBL

st

1.

Inventory 1

day of month

0

0

0

0

0

0

(Line 10, Previous Monthly Report)

2.

Purchases from brewers during month

0

0

0

0

0

0

(Total Schedule A)

3.

Purchases from other Ga.

wholesalers during month (Total

0

0

0

0

0

0

Schedule B)

4.

Total possessed this month

0

0

0

0

0

0

(Total Lines 1 through 3)

5.

Sales to other Ga. wholesalers during

0

0

0

0

0

0

month (Total Schedule C)

6.

Sales to military installations during

0

0

0

0

0

0

month (Total Schedule D)

7.

Sales to dealers and employees

0

0

0

0

0

0

during month (Total Schedule E)

8.

Additional Dispositions

0

0

0

0

0

0

(Total Schedule F)

9.

Total disposal during month

0

0

0

0

0

0

(Total Lines 5 through 8)

10.

Physical inventory—last day of month

0

0

0

0

0

0

11.

Disposal and Inventory

0

0

0

0

0

0

(Total Lines 9 and10)

12.

Difference , if any (+ or -), between

0

0

0

0

0

0

Lines 4 and 11

13.

Total taxable

(Total Lines 9 and 12, less Lines 3

0

0

0

0

0

0

and 6)

$0.48

$1.30

$1.67

$2.50

$5.00

$10.00

14.

Ga. Excise Tax rate per gallon

15.

Tax due by size

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

(Line 13 X Line 14)

16.

Gross Tax Due

$0.00

(Total of all columns in Line 15)

SUBMIT REPORT AND REMITTANCE TO:

17.

Less attached credit memorandums

issued by Ga. Department of

$0.00

GEORGIA DEPARTMENT OF REVENUE

Revenue

PO BOX 105458

18.

Net Tax Due

$0.00

ATLANTA, GA 30374-5458

(Line 16 less Line 17)

AFFIDAVIT

I hereby certify, under penalty of law, that this is a true and correct report including supporting schedules and documents, of the

malt beverage transactions during the month shown above.

SIGNED _________________________________

TITLE

_____________________________

(Owner, Officer, or General Manager)

Subscribed and sworn to before me this _____ day of _________________________

, 20___________

__________________________________________________________________

(

N

o

a t

y r

P

u

i l b

) c

1

1