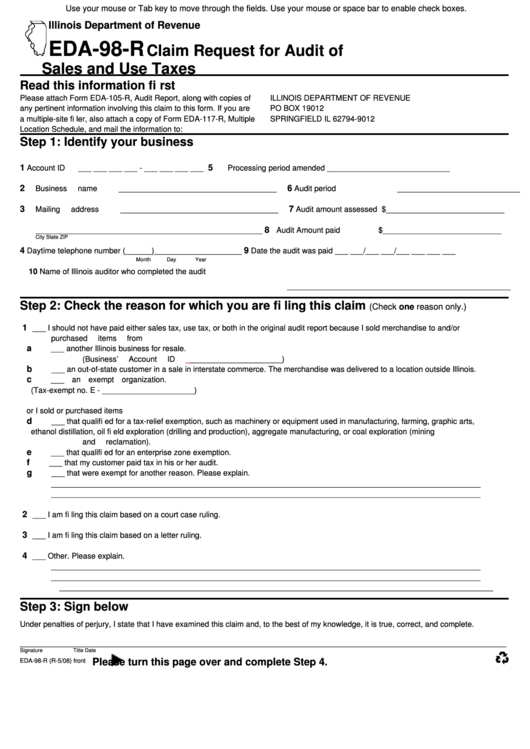

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

EDA-98-R

Claim Request for Audit of

Sales and Use Taxes

Read this information fi rst

Please attach Form EDA-105-R, Audit Report, along with copies of

ILLINOIS DEPARTMENT OF REVENUE

any pertinent information involving this claim to this form. If you are

PO BOX 19012

a multiple-site fi ler, also attach a copy of Form EDA-117-R, Multiple

SPRINGFIELD IL 62794-9012

Location Schedule, and mail the information to:

Step 1: Identify your business

1

5

Account ID

___ ___ ___ ___ - ___ ___ ___ ___

Processing period amended ____________________________

2

6

Business name

____________________________________

Audit period

____________________________

3

7

Mailing address

____________________________________

Audit amount assessed

$___________________________

8

__________________________________________________

Audit Amount paid

$___________________________

__

City

State

ZIP

4

9

Daytime telephone number

(______)____________________

Date the audit was paid

___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

10 Name of Illinois auditor who completed the audit

___________________________________________________

Step 2: Check the reason for which you are fi ling this claim

(Check one reason only.)

1

___ I should not have paid either sales tax, use tax, or both in the original audit report because I sold merchandise to and/or

purchased items from

a

___ another Illinois business for resale.

(Business’ Account ID ______________________)

b

___ an out-of-state customer in a sale in interstate commerce. The merchandise was delivered to a location outside Illinois.

c

___ an exempt organization.

(Tax-exempt no. E - _____________________)

or I sold or purchased items

d

___ that qualifi ed for a tax-relief exemption, such as machinery or equipment used in manufacturing, farming, graphic arts,

ethanol distillation, oil fi eld exploration (drilling and production), aggregate manufacturing, or coal exploration (mining

and reclamation).

e

___ that qualifi ed for an enterprise zone exemption.

f

___ that my customer paid tax in his or her audit.

g

___ that were exempt for another reason. Please explain.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

2

___ I am fi ling this claim based on a court case ruling.

3

___ I am fi ling this claim based on a letter ruling.

4

___ Other. Please explain.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

___________________________________________________________________________________________________

Step 3: Sign below

Under penalties of perjury, I state that I have examined this claim and, to the best of my knowledge, it is true, correct, and complete.

_______________________________________________________________________________________________________________

Signature

Title

Date

EDA-98-R (R-5/08) front

Please turn this page over and complete Step 4.

1

1 2

2