Real Property Petition Form - The Skagit County Board Of Equalization

ADVERTISEMENT

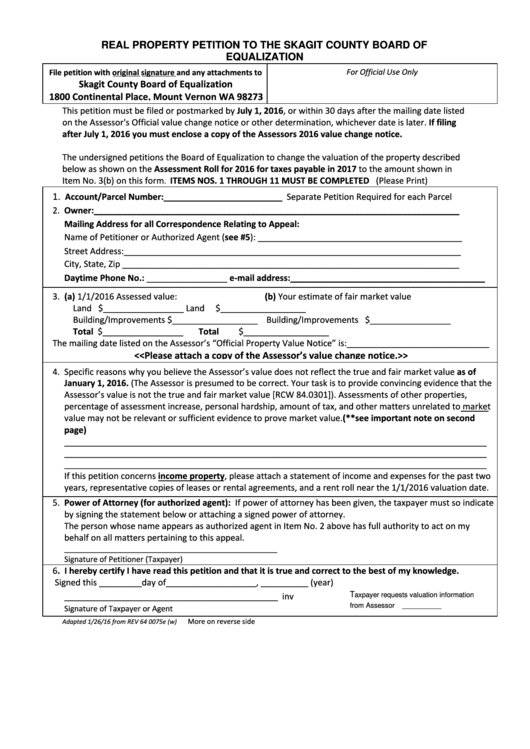

REAL PROPERTY PETITION TO THE SKAGIT COUNTY BOARD OF

EQUALIZATION

File petition with original signature and any attachments to

For Official Use Only

Skagit County Board of Equalization

1800 Continental Place, Mount Vernon WA 98273

This petition must be filed or postmarked by July 1, 2016, or within 30 days after the mailing date listed

on the Assessor's Official value change notice or other determination, whichever date is later. If filing

after July 1, 2016 you must enclose a copy of the Assessors 2016 value change notice.

The undersigned petitions the Board of Equalization to change the valuation of the property described

below as shown on the Assessment Roll for 2016 for taxes payable in 2017 to the amount shown in

Item No. 3(b) on this form

ITEMS NOS. 1 THROUGH 11 MUST BE COMPLETED (Please Print)

.

1.

Account/Parcel Number:_________________________ Separate Petition Required for each Parcel

2. Owner:_____________________________________________________________________________

Mailing Address for all Correspondence Relating to Appeal:

Name of Petitioner or Authorized Agent (see #5): ___________________________________________

Street Address:_______________________________________________________________________

City, State, Zip _______________________________________________________________________

Daytime Phone No.: _________________ e-mail address:_________________________________________

3. (a) 1/1/2016 Assessed value:

(b) Your estimate of fair market value

Land

$_________________

Land

$__________________

Building/Improvements $__________________ Building/Improvements $_________________

Total

$_________________

Total

$__________________

The mailing date listed on the Assessor’s “Official Property Value Notice” is:______________________________

<<Please attach a copy of the Assessor’s value change notice.>>

4. Specific reasons why you believe the Assessor’s value does not reflect the true and fair market value as of

January 1, 2016. (The Assessor is presumed to be correct. Your task is to provide convincing evidence that the

Assessor’s value is not the true and fair market value [RCW 84.0301]). Assessments of other properties,

percentage of assessment increase, personal hardship, amount of tax, and other matters unrelated to market

value may not be relevant or sufficient evidence to prove market value.(**see important note on second

page)

_________________________________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

If this petition concerns income property, please attach a statement of income and expenses for the past two

years, representative copies of leases or rental agreements, and a rent roll near the 1/1/2016 valuation date.

5. Power of Attorney (for authorized agent): If power of attorney has been given, the taxpayer must so indicate

by signing the statement below or attaching a signed power of attorney.

The person whose name appears as authorized agent in Item No. 2 above has full authority to act on my

behalf on all matters pertaining to this appeal.

__________________________________________________

Signature of Petitioner (Taxpayer)

6. I hereby certify I have read this petition and that it is true and correct to the best of my knowledge.

Signed this _________day of___________________, __________ (year)

T

_____________________________________________

inv

axpayer requests valuation information

from Assessor

__________

Signature of Taxpayer or Agent

More on reverse side

Adapted 1/26/16 from REV 64 0075e (w)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3