Form Pda-46 - Minnesota Gasoline Tax Return

ADVERTISEMENT

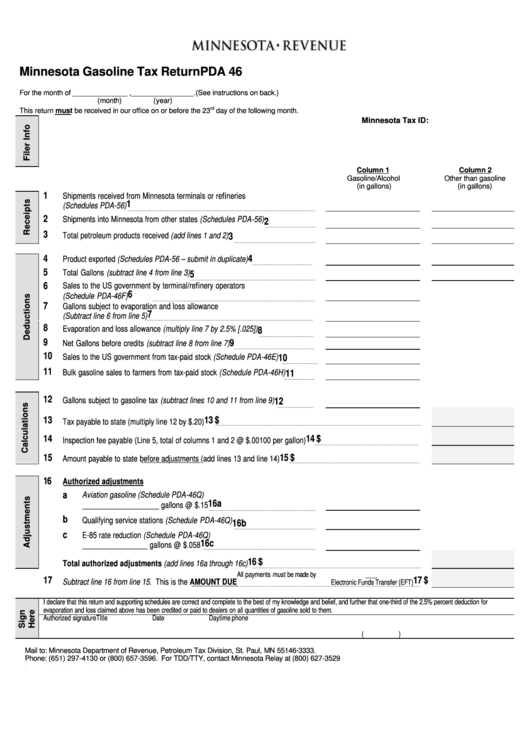

Minnesota Gasoline Tax Return

PDA 46

For the month of ______________ ,________________.

(See instructions on back.)

(month)

(year)

rd

This return must be received in our office on or before the 23

day of the following month.

Minnesota Tax ID:

Column 1

Column 2

Gasoline/Alcohol

Other than gasoline

(in gallons)

(in gallons)

1

Shipments received from Minnesota terminals or refineries

1

(Schedules PDA-56)

2

Shipments into Minnesota from other states (Schedules PDA-56)

2

3

3

Total petroleum products received (add lines 1 and 2)

4

4

Product exported (Schedules PDA-56 – submit in duplicate)

5

Total Gallons (subtract line 4 from line 3)

5

6

Sales to the US government by terminal/refinery operators

6

(Schedule PDA-46F)

7

Gallons subject to evaporation and loss allowance

7

(Subtract line 6 from line 5)

8

Evaporation and loss allowance (multiply line 7 by 2.5% [.025])

8

9

9

Net Gallons before credits (subtract line 8 from line 7)

10

10

Sales to the US government from tax-paid stock (Schedule PDA-46E)

11

11

Bulk gasoline sales to farmers from tax-paid stock (Schedule PDA-46H)

12

12

Gallons subject to gasoline tax (subtract lines 10 and 11 from line 9)

13

13 $

Tax payable to state (multiply line 12 by $.20)

14

14 $

Inspection fee payable (Line 5, total of columns 1 and 2 @ $.00100 per gallon)

15

15 $

Amount payable to state before adjustments (add lines 13 and line 14)

16

Authorized adjustments

a

Aviation gasoline (Schedule PDA-46Q)

16a

____________________ gallons @ $.15

b

Qualifying service stations (Schedule PDA-46Q)

16b

c

E-85 rate reduction (Schedule PDA-46Q)

16c

_________________ gallons @ $.058

16 $

Total authorized adjustments (add lines 16a through 16c)

All payments must be made by

17

17 $

Subtract line 16 from line 15. This is the AMOUNT DUE

Electronic Funds Transfer (EFT)

I declare that this return and supporting schedules are correct and complete to the best of my knowledge and belief, and further that one-third of the 2.5% percent deduction for

evaporation and loss claimed above has been credited or paid to dealers on all quantities of gasoline sold to them.

Authorized signature

Title

Date

Daytime phone

(

)

Mail to: Minnesota Department of Revenue, Petroleum Tax Division, St. Paul, MN 55146-3333.

Phone: (651) 297-4130 or (800) 657-3596. For TDD/TTY, contact Minnesota Relay at (800) 627-3529

Rev 8/01 - Printed on recycled paper with 10% post-consumer waste

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2