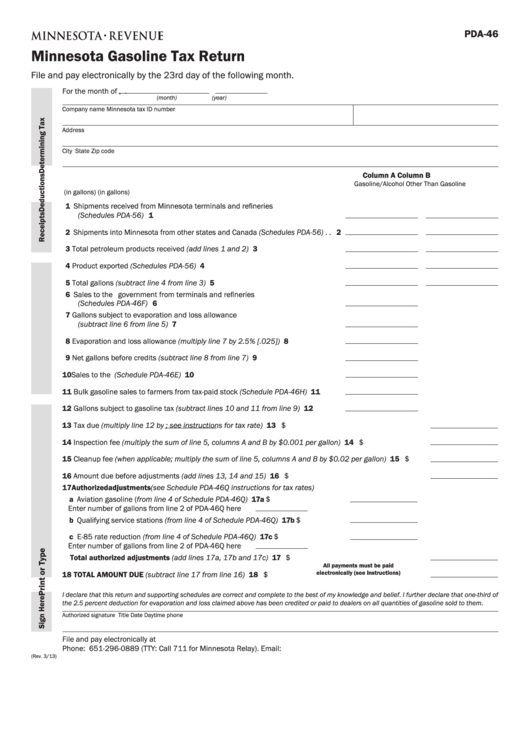

PDA-46

Minnesota Gasoline Tax Return

File and pay electronically by the 23rd day of the following month .

For the month of

,

.

(month)

(year)

Company name

Minnesota tax ID number

Address

City

State

Zip code

Column A

Column B

Gasoline/Alcohol

Other Than Gasoline

(in gallons)

(in gallons)

1 Shipments received from Minnesota terminals and refineries

(Schedules PDA-56) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Shipments into Minnesota from other states and Canada (Schedules PDA-56) . . 2

3 Total petroleum products received (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . 3

4 Product exported (Schedules PDA-56) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total gallons (subtract line 4 from line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Sales to the U.S. government from terminals and refineries

(Schedules PDA-46F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Gallons subject to evaporation and loss allowance

(subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Evaporation and loss allowance (multiply line 7 by 2.5% [.025]) . . . . . . . . . . . . . 8

9 Net gallons before credits (subtract line 8 from line 7) . . . . . . . . . . . . . . . . . . . . 9

10 Sales to the U .S . government from tax-paid stock (Schedule PDA-46E) . . . . . . 10

11 Bulk gasoline sales to farmers from tax-paid stock (Schedule PDA-46H) . . . . . 11

12 Gallons subject to gasoline tax (subtract lines 10 and 11 from line 9) . . . . . . . 12

13 Tax due (multiply line 12 by

; see instructions for tax rate) . . . . . . . . . . . . . . . . . . . . . . . . 13 $

14 Inspection fee (multiply the sum of line 5, columns A and B by $0.001 per gallon) . . . . . . . . . . . . . . . . . 14 $

15 Cleanup fee (when applicable; multiply the sum of line 5, columns A and B by $0.02 per gallon) . . . . . 15 $

16 Amount due before adjustments (add lines 13, 14 and 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 $

17 Authorized adjustments (see Schedule PDA-46Q instructions for tax rates)

a Aviation gasoline (from line 4 of Schedule PDA-46Q) . . . . . . . . . . . . . . . . . . 17a $

Enter number of gallons from line 2 of PDA-46Q here

b Qualifying service stations (from line 4 of Schedule PDA-46Q) . . . . . . . . . . 17b $

c E-85 rate reduction (from line 4 of Schedule PDA-46Q) . . . . . . . . . . . . . . . . 17c $

Enter number of gallons from line 2 of PDA-46Q here

Total authorized adjustments (add lines 17a, 17b and 17c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 $

All payments must be paid

electronically (see instructions)

18 TOTAL AMOUNT DUE (subtract line 17 from line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 $

I declare that this return and supporting schedules are correct and complete to the best of my knowledge and belief. I further declare that one-third of

the 2.5 percent deduction for evaporation and loss claimed above has been credited or paid to dealers on all quantities of gasoline sold to them.

Authorized signature

Title

Date

Daytime phone

File and pay electronically at www .revenue .state .mn .us . Keep a signed copy of this return with your tax records .

Phone: 651-296-0889 (TTY: Call 711 for Minnesota Relay) . Email: petroleum .tax@state .mn .us

(Rev . 3/13)

1

1 2

2