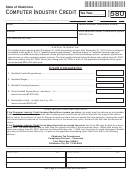

Form 580

Credit for Data Processing Services, Computer Systems Design Services

and Other Computer Related Services

Title 68 O.S. Section 2357.201

Instructions

Lines 1 - 3

Enter the qualified expenditures upon which the credit will be computed. Expenditures incurred January 1, 2005 through

December 31, 2013 may be used for purposes of the credit calculation. Qualified expenses may be added together

or considered independently, but the total upon which the credit is based cannot exceed $2,333,333.00. Qualified

expenditures incurred, but not used due to the $2,333,333.00 limit, may be used on a succeeding year’s Form 580.

Line 4

Total qualified expenditures. Add lines 1 - 3; cannot be more than $2,333,333.00.

Line 5

Multiply line 4 by 15%. The maximum credit allowed during the fiscal year ending June 30, 2007; June 30, 2008; June

30, 2009 or each of the applicable subsequent fiscal years is $350,000.00. Note: If claiming this credit on an income tax

return, the credit should be entered on the estimated tax line of such return.

Definitions

“Qualified business enterprise” means an entity or affiliated group of entities electing to file a consolidated Oklahoma

income tax return:

a. organized as a corporation, partnership, limited liability company or other entity having limited liability pursuant to

the laws of the State of Oklahoma or the laws of another state, if such entity is registered to do business within

the state, a general partnership, limited liability partnership, limited liability limited partnership or other legal entity

having the right to conduct lawful business within the state,

b. whose principal business activities are described by the North American Industry Classification System by

Industry No. 514210, 541512 or 541519 as reflected in the 1997 edition of such publication,

c. that makes at least 75% of its sales to out-of-state customers or buyers which shall be determined in the same

manner as provided for purposes of the Oklahoma Quality Jobs Program Act,

d. that is a high-speed processing facility in Oklahoma utilizing systems such as TPF, zTPF or other advanced

technical systems, and that, as of July 1, 2005, maintains an Oklahoma annual payroll of at least $85,000,000.00

and an Oklahoma labor force of 1,000 or more persons.

“Qualified capital expenditures” means those costs incurred by the qualified business enterprise for acquisition of

personal property to be used in business operations within the state that qualifies for depreciation and/or amortization

pursuant to the Internal Revenue Code of 1986, as amended, during the taxable year for which the credit authorized by

this section is claimed, or costs incurred to refurbish, repair or maintain any existing personal property located within the

state.

“Qualified wages” means compensation, including any employer-paid health care benefits, to full-time or part-time

employees of the qualified business enterprise if such employees are full-time residents of the state.

“Qualified training expenses” means those costs, whether or not deductible as a business expense pursuant to

the Internal Revenue Code of 1986, as amended, incurred to locate, interview, hire and educate an employee of the

enterprise who has not previously been employed by the enterprise and who is a resident of the state.

1

1 2

2