Form 11a - Wyoming Vendor Sales/use Tax Return, Ets Form 10a - Wyoming Vendor Sales/use Tax Return Page 3

ADVERTISEMENT

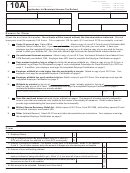

ETS Form 10a (Sales Tax Worksheet for ETS Form 10) (

ETS Form 10a (Sales Tax Worksheet for ETS Form 10) (

ETS Form 10a (Sales Tax Worksheet for ETS Form 10) (

)

)

)

continued

continued

continued

Lines 4A, 4B, 4C & 4D … Please note that your sales/use tax return requires you to report sales that

Lines 4A, 4B, 4C & 4D … Please note that your sales/use tax return requires you to report sales that

Lines 4A, 4B, 4C & 4D … Please note that your sales/use tax return requires you to report sales that

may have taken place at a location other than your primary business address. If you make deliveries to

may have taken place at a location other than your primary business address. If you make deliveries to

may have taken place at a location other than your primary business address. If you make deliveries to

or conduct a sale in any county other than your primary licensed location, (please note that the tax rate

or conduct a sale in any county other than your primary licensed location, (please note that the tax rate

or conduct a sale in any county other than your primary licensed location, (please note that the tax rate

varies in each county) show the total net taxable sales for that location on Lines 4B. Sales listed on

varies in each county) show the total net taxable sales for that location on Lines 4B. Sales listed on

varies in each county) show the total net taxable sales for that location on Lines 4B. Sales listed on

Lines 4B and Line 5 must equal Line 3, (Total Amount Subject to Sales Tax) on your return.

Lines 4B and Line 5 must equal Line 3, (Total Amount Subject to Sales Tax) on your return.

Lines 4B and Line 5 must equal Line 3, (Total Amount Subject to Sales Tax) on your return.

Line No.

.

Line No. 4E.

Total sales tax due (total of columns 4D):……

…………………………………..

4E

Amount Subject to

.

.

Lodging Tax

Line No. 5.

x Lodging Tax Rate ________ =

5.

.

Line No. 6.

Excess Tax Collected (if calculated tax is less than tax actually collected)…

6.

Wyoming vendor's Out of

Wyoming vendor's Out of

Wyoming vendor's Out of

.

.

7.

Line No. 7.

x Tax Rate of _____=

State purchases……………….

State purchases……………….

State purchases……………….

(purchase of goods consumed by you in your business or not placed in your sales inventory)

.

8.

Line No. 8.

Total tax due (Add Lines 4E, 5, 6, and 7.)…………………………………...…

Line No. 9.A. Interest for late payment is calculated daily for each day the payment is late,

Line No. 9.A. Interest for late payment is calculated daily for each day the payment is late,

Line No. 9.A. Interest for late payment is calculated daily for each day the payment is late,

.

9.A.

times line 8. See below for interest rate information………………………...

times line 8. See below for interest rate information………………………...

times line 8. See below for interest rate information………………………...

+

.

9.B.

Line No. 9.B. Penalty for late payment is an additional 10% times line 8……………...

Line No. 9.B. Penalty for late payment is an additional 10% times line 8……………...

Line No. 9.B. Penalty for late payment is an additional 10% times line 8……………...

Line No. 9.C. Penalty for failure to file a properly completed Department of Revenue

Line No. 9.C. Penalty for failure to file a properly completed Department of Revenue

Line No. 9.C. Penalty for failure to file a properly completed Department of Revenue

+

.

9.C.

Form 10 by the due date will result in a penalty of $10.00………………

Form 10 by the due date will result in a penalty of $10.00………………

Form 10 by the due date will result in a penalty of $10.00………………

Line No. 9.D. Penalty for failure to file a properly completed Department of Revenue

Line No. 9.D. Penalty for failure to file a properly completed Department of Revenue

Line No. 9.D. Penalty for failure to file a properly completed Department of Revenue

+

.

9.D.

Form 10 within 30 days after notice will result in an additional $25.00

Form 10 within 30 days after notice will result in an additional $25.00

Form 10 within 30 days after notice will result in an additional $25.00

Line No. 9.E. Credit Notification (Form No. 72), received by you from the Department

Line No. 9.E. Credit Notification (Form No. 72), received by you from the Department

.

of Revenue………………………………………………………………….

of Revenue………………………………………………………………….

9.E.

Line No. 9.

Line No. 9.

Total Adjustments: Add Lines 9.A., 9.B., 9.C. and 9.D, then subtract

Total Adjustments: Add Lines 9.A., 9.B., 9.C. and 9.D, then subtract

.

any credit entered on Line 9.E. Enter resulting amount here……...........

any credit entered on Line 9.E. Enter resulting amount here……...........

=

9.

Use minus sign (e.g. -"123.45") for negative numbers (credits).

Use minus sign (e.g. -"123.45") for negative numbers (credits).

.

Line No. 10.

Total Due: (Line 8 + Line 9)………… ………………………………………………..

10.

****IMPORTANT INFORMATION****

****IMPORTANT INFORMATION****

- Penalty for late payment is 10% of tax due.

- Penalty for late payment is 10% of tax due.

- Penalty for failure to file a properly completed Department of Revenue Form 10 by the

- Penalty for failure to file a properly completed Department of Revenue Form 10 by the

due date will result in a penalty of up to $35.00.

due date will result in a penalty of up to $35.00.

- Interest for late payment is calculated per day for each day the payment is late. For the

- Interest for late payment is calculated per day for each day the payment is late. For the

current interest rate, contact the Department of Revnue at (307) 777-5200 or visit our

current interest rate, contact the Department of Revnue at (307) 777-5200 or visit our

website at

website at

Lines 1, 2, 3, 4E, 8 and 10 must be completed on all forms.

Lines 1, 2, 3, 4E, 8 and 10 must be completed on all forms.

Do not send this form to the Department. Retain this worksheet and documentation to support

Do not send this form to the Department. Retain this worksheet and documentation to support

the tax return you have filed with the Department! If you have any questions regarding your

the tax return you have filed with the Department! If you have any questions regarding your

Wyoming Sales/Use Tax return preparation, please phone the Department Field Representative

Wyoming Sales/Use Tax return preparation, please phone the Department Field Representative

assigned to your area or phone (307) 777-5200.

assigned to your area or phone (307) 777-5200.

Please notify the Department of Revenue in writing if you have discontinued business, made a

Please notify the Department of Revenue in writing if you have discontinued business, made a

change in ownership, moved your location of business or changed your mailing address.

change in ownership, moved your location of business or changed your mailing address.

[Visit our home page at for more information]

Prepared by:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3