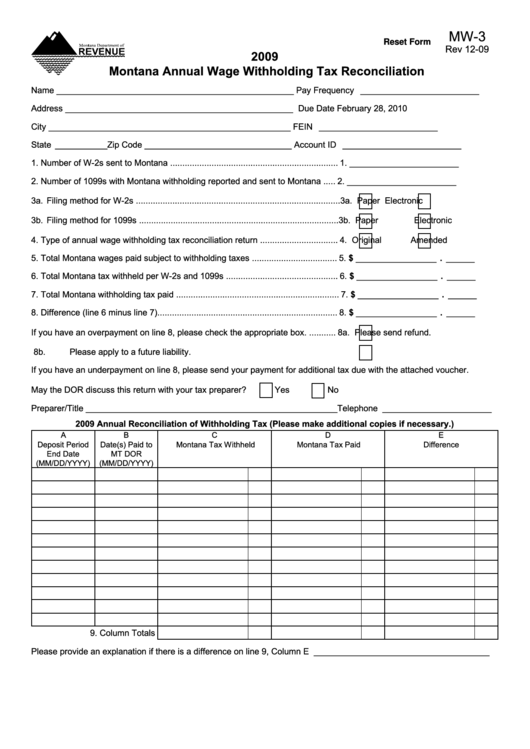

MW-3

Reset Form

Rev_12-09

2009

Montana Annual Wage Withholding Tax Reconciliation

Name___________________________________________________ _

Pay_Frequency_ _ _________________________

Address_________________________________________________ _

Due_Date_

February_28,_2010

City_ ___________________________________________________ _

FEIN_

_ _________________________

State_ ___________ Zip_Code________________________________ _

Account_ID_

_ _________________________

1._ Number_of_W-2s_sent_to_Montana_..................................................................... 1.________________________

2._ Number_of_1099s_with_Montana_withholding_reported_and_sent_to_Montana_ . .... 2.________________________

3a._ Filing_method_for_W-2s_.................................................................................... 3a._

_Paper_

_Electronic

3b._ Filing_method_for_1099s_.................................................................................. 3b._

_Paper_

_Electronic

4._ Type_of_annual_wage_withholding_tax_reconciliation_return_ . ............................... 4._

_Original_

_Amended

5._ Total_Montana_wages_paid_subject_to_withholding_taxes_................................... 5._ $_ _ ________________ ._ ______

6._ Total_Montana_tax_withheld_per_W-2s_and_1099s_.............................................. 6._ $_ _ ________________ ._ ______

7._ Total_Montana_withholding_tax_paid_ . .................................................................. 7._ $_ _ ________________ ._ ______

8._ Difference_(line_6_minus_line_7).......................................................................... 8._ $_ _ ________________ ._ ______

If_you_have_an_overpayment_on_line_8,_please_check_the_appropriate_box._........... 8a._

_Please_send_refund.

_

8b._

_Please_apply_to_a_future_liability.

If_you_have_an_underpayment_on_line_8,_please_send_your_payment_for_additional_tax_due_with_the_attached_voucher.

May_the_DOR_discuss_this_return_with_your_tax_preparer?_

_Yes_

_No

Preparer/Title_ _ ____________________________________________________ Telephone_ _______________________

2009 Annual Reconciliation of Withholding Tax (Please make additional copies if necessary.)

A_

B_

C_

D_

E_

Deposit_Period_

Date(s)_Paid_to_

Montana_Tax_Withheld

Montana_Tax_Paid

Difference

End_Date_

MT_DOR_

(MM/DD/YYYY)

(MM/DD/YYYY)

9._Column_Totals

Please_provide_an_explanation_if_there_is_a_difference_on_line_9,_Column_E_______________________________________

1

1