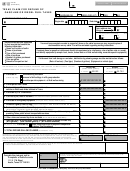

Form 12-104 (Back)(Rev.8-09/6)

INSTRUCTIONS FOR COMPLETING CLAIM FOR REFUND

OF STATE HOTEL OCCUPANCY TAX

GENERAL INSTRUCTIONS

WHO MAY FILE:

A United States governmental entity that paid the Texas state hotel occupancy tax directly to the hotel for

its employees when they were conducting official business on behalf of the entity. Federal entities that

reimbursed employees for taxes paid by the employees while traveling may also file a claim.

State agencies, boards, commissions and institutions that do not use the Uniform Statewide Accounting

System (USAS) to reimburse employee travel expenses.

Texas institutions of higher education and their employees traveling on official business are exempted

from state hotel tax and should be providing hotels with an exemption certificate. No refund is available

using this form.

WHEN TO FILE:

This form may be used to file a refund claim for up to four fiscal quarters within the same fiscal year. You

may file only one claim per fiscal quarter.

FOR ASSISTANCE: Call (800) 531-5441, ext. 3-4545 or (512) 463-4545.

SPECIFIC INSTRUCTIONS

Item c - Enter the 11-digit taxpayer number assigned by the State of Texas. If you do not have a number assigned by the

state, use your Federal Employer’s Identification (FEI) Number.

Items d-h - Enter your agency name and the complete address of the location filing the claim.

Item i - Enter the fiscal year during which the hotel occupancy tax was paid. The state's fiscal year is September 1

through August 31.

Items j-m - Darken the box(es) for the appropriate fiscal quarter(s).

Items 1-4 - Enter the cost of hotel rooms (excluding taxes, meals and other services) paid within the city limits of

Galveston, Texas for the applicable fiscal quarter(s) (Dollars and cents).

Item 5 - Enter the total of hotel room costs paid within the city limits of Galveston, Texas for the fiscal year covered (add

Items 1, 2, 3 and 4) (Dollars and cents).

Items 6-9 - Enter the cost of hotel rooms (excluding taxes, meals and other services) paid within the city limits of South

Padre Island, Texas for the applicable fiscal quarter(s) (Dollars and cents).

Item 10 - Enter the total of hotel room costs paid within the city limits of South Padre Island, Texas for the fiscal year

covered (add Items 6, 7, 8 and 9) (Dollars and cents).

Items 11-14 - Enter the cost of hotel rooms (excluding taxes, meals and other services) paid within the city limits of Port

Aransas, Texas for the applicable fiscal quarter(s) (Dollars and cents).

Item 15 - Enter the total of hotel room costs paid within the city limits of Port Aransas, Texas for the fiscal year covered

(add Items 11, 12, 13 and 14) (Dollars and cents).

Items 16-19 - Enter the total cost of hotel rooms (excluding taxes, meals and other services) paid in all cities, including

Galveston, South Padre Island and Port Aransas, for the applicable fiscal quarter(s) (Dollars and cents).

Item 20 - Enter the total of all hotel room costs paid in all cities for the fiscal year covered (add Items 16, 17, 18 and 19)

(Dollars and cents).

Item 21 - Enter the amount of state hotel tax refund requested (multiply the amount in Item 20 by .06000) (Dollars and

cents). NOTE: The state tax rate is 6%. The city and/or county where the hotel is located may also impose a

local hotel tax. You may contact the appropriate local taxing jurisdiction to request a refund claim form.

Item o - Darken the “YES” box if you are filing this claim to correct a claim previously filed in error for one or more of the

fiscal quarters included in this claim. Darken the “NO” box if this is the only claim filed for all fiscal quarters.

1

1 2

2