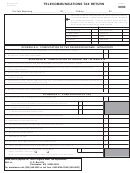

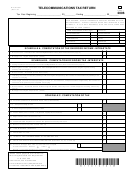

Form Wv/tel-501 - Telecommunications Tax Return - 2006 Page 2

ADVERTISEMENT

INSTRUCTIONS FOR QUESTIONS ONE THROUGH SEVEN

Please answer all questions:

1. If you purchased this business during the last twelve (12) months, give the name and last known address of the

previous owner. A successor in business could become liable for outstanding taxes owed by a previous owner. If you

did

not

purchase

this

business

during

the

last

twelve

(12)

months,

write

“non

appli-

cable”._________________________________________________________________________________________

2. If you quit business during the last twelve (12) months, write “yes” in the space provided and give the exact date you

quit. If you did not, write “no” in the space. If you sold your business during the last twelve (12) months, write “yes” in

the space provided, give the date of the sale, and provide the full name and address of the new owner. If you did not

sell this business, write “no” in the space.

a. Quit Business?________ Sell or otherwise dispose of your business?_______ Exact date _____________________

b. If business was sold, give exact name and address of new owner ________________________________________

____________________________________________________________________________________________________________

3. Give the mailing address where you keep your records. If it is the same as the address where we sent this return, write

“same” in the space._______________________________________________________________________________

4. Principal place of business in West Virginia. Write the name of the city or town in West Virginia where you conduct the

majority of your business. _______________________________________________________________________

5. Nature of business conducted. Describe in detail the type of business you are engaged in. _________________________

____________________________________________________________________________________________________________

6. Print or type the full name and telephone number of the person preparing this return. It is much easier to discuss and

correct irregularities found on returns over the telephone than by correspondence._______________________________

_________________________________________________________________________________________________

7. If you operate any other businesses in West Virginia, give the name and account number for each. If you operate no

other businesses, write “none”.______________________________________________________________________

____________________________________________________________________________________________________________

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statement(s),and to the

best of my knowledge and belief it is true, and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact concerning this Return)

(Telephone Number)

(Signature of preparer other than taxpayer)

(Address)

(Date)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2