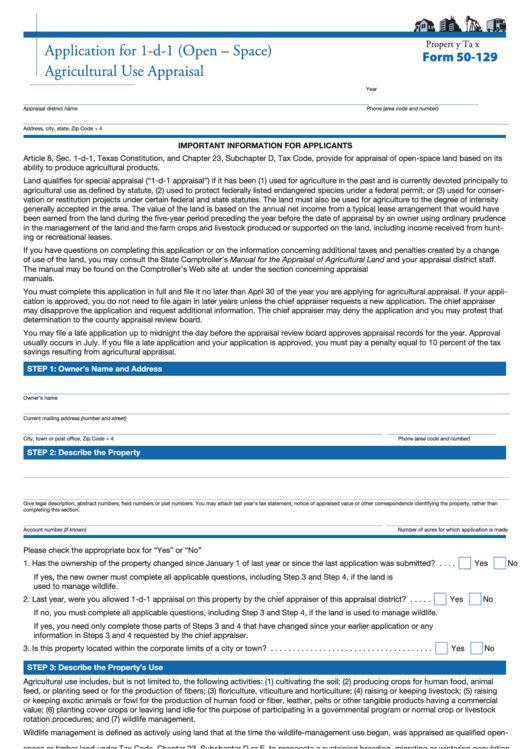

P r o p e r t y T a x

Application for 1-d-1 (Open – Space)

Form 50-129

Agricultural Use Appraisal

________________________

Year

_______________________________________________________________________________

________________________

Appraisal district name

Phone (area code and number)

_______________________________________________________________________________________________________________

Address, city, state, Zip Code + 4

IMPORTANT INFORMATION FOR APPLICANTS

Article 8, Sec. 1-d-1, Texas Constitution, and Chapter 23, Subchapter D, Tax Code, provide for appraisal of open-space land based on its

ability to produce agricultural products.

Land qualifies for special appraisal (“1-d-1 appraisal”) if it has been (1) used for agriculture in the past and is currently devoted principally to

agricultural use as defined by statute, (2) used to protect federally listed endangered species under a federal permit, or (3) used for conser-

vation or restitution projects under certain federal and state statutes. The land must also be used for agriculture to the degree of intensity

generally accepted in the area. The value of the land is based on the annual net income from a typical lease arrangement that would have

been earned from the land during the five-year period preceding the year before the date of appraisal by an owner using ordinary prudence

in the management of the land and the farm crops and livestock produced or supported on the land, including income received from hunt-

ing or recreational leases.

If you have questions on completing this application or on the information concerning additional taxes and penalties created by a change

of use of the land, you may consult the State Comptroller’s Manual for the Appraisal of Agricultural Land and your appraisal district staff.

The manual may be found on the Comptroller’s Web site at under the section concerning appraisal

manuals.

You must complete this application in full and file it no later than April 30 of the year you are applying for agricultural appraisal. If your appli-

cation is approved, you do not need to file again in later years unless the chief appraiser requests a new application. The chief appraiser

may disapprove the application and request additional information. The chief appraiser may deny the application and you may protest that

determination to the county appraisal review board.

You may file a late application up to midnight the day before the appraisal review board approves appraisal records for the year. Approval

usually occurs in July. If you file a late application and your application is approved, you must pay a penalty equal to 10 percent of the tax

savings resulting from agricultural appraisal.

STEP 1: Owner’s Name and Address

_______________________________________________________________________________________________________________

Owner’s name

_______________________________________________________________________________________________________________

Current mailing address (number and street)

__________________________________________________________________________________

_ ________________________

City, town or post office, Zip Code + 4

Phone (area code and number)

STEP 2: Describe the Property

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

Give legal description, abstract numbers, field numbers or plat numbers. You may attach last year’s tax statement, notice of appraised value or other correspondence identifying the property, rather than

completing this section.

__________________________________________________________________________________

_ ________________________

Account number (if known)

Number of acres for which application is made

Please check the appropriate box for “Yes” or “No”

1. Has the ownership of the property changed since January 1 of last year or since the last application was submitted? . . . .

Yes

No

If yes, the new owner must complete all applicable questions, including Step 3 and Step 4, if the land is

used to manage wildlife.

2. Last year, were you allowed 1-d-1 appraisal on this property by the chief appraiser of this appraisal district? . . . . .

Yes

No

If no, you must complete all applicable questions, including Step 3 and Step 4, if the land is used to manage wildlife.

If yes, you need only complete those parts of Steps 3 and 4 that have changed since your earlier application or any

information in Steps 3 and 4 requested by the chief appraiser.

3. Is this property located within the corporate limits of a city or town? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

STEP 3: Describe the Property’s Use

Agricultural use includes, but is not limited to, the following activities: (1) cultivating the soil; (2) producing crops for human food, animal

feed, or planting seed or for the production of fibers; (3) floriculture, viticulture and horticulture; (4) raising or keeping livestock; (5) raising

or keeping exotic animals or fowl for the production of human food or fiber, leather, pelts or other tangible products having a commercial

value; (6) planting cover crops or leaving land idle for the purpose of participating in a governmental program or normal crop or livestock

rotation procedures; and (7) wildlife management.

Wildlife management is defined as actively using land that at the time the wildlife-management use began, was appraised as qualified open-

space or timber land under Tax Code, Chapter 23, Subchapter D or E, to propagate a sustaining breeding, migrating or wintering population

of indigenous wild animals for human use, including food, medicine, or recreation, in at least three of the following ways: (1) habitat control;

(2) erosion control; (3) predator control; (4) providing supplemental supplies of water; (5) providing supplement supplies of food; (6) providing

shelters; and (7) making census counts to determine population.

Wildlife management is also actively using land to protect federally listed endangered species under a federal permit if the land is in a habitat

preserve subject to a conservation easement or part of a conservation development under a federally approved habitat conservation plan

restricting the use of the land. Actively using land for a conservation or restoration project under certain federal and state statutes is wildlife

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-129 • 4-10/9

Continue on next page

1

1 2

2 3

3 4

4