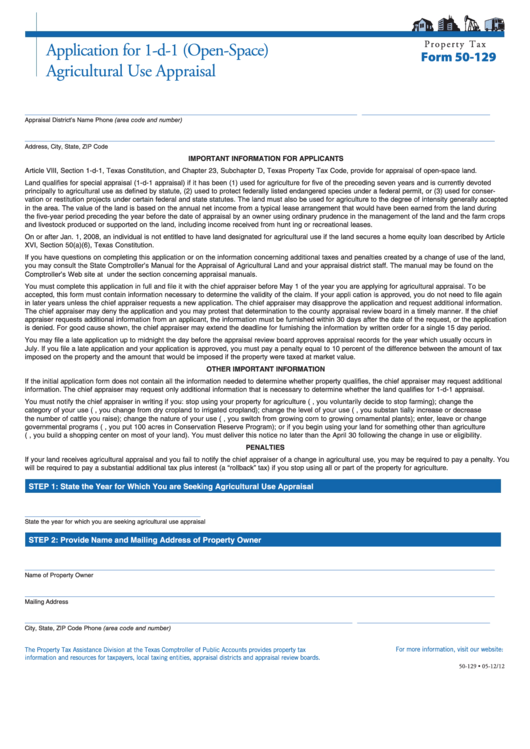

P r o p e r t y T a x

Application for 1-d-1 (Open-Space)

Form 50-129

Agricultural Use Appraisal

______________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

IMPORTANT INFORMATION FOR APPLICANTS

Article VIII, Section 1-d-1, Texas Constitution, and Chapter 23, Subchapter D, Texas Property Tax Code, provide for appraisal of open-space land.

Land qualifies for special appraisal (1-d-1 appraisal) if it has been (1) used for agriculture for five of the preceding seven years and is currently devoted

principally to agricultural use as defined by statute, (2) used to protect federally listed endangered species under a federal permit, or (3) used for conser-

vation or restitution projects under certain federal and state statutes. The land must also be used for agriculture to the degree of intensity generally accepted

in the area. The value of the land is based on the annual net income from a typical lease arrangement that would have been earned from the land during

the five-year period preceding the year before the date of appraisal by an owner using ordinary prudence in the management of the land and the farm crops

and livestock produced or supported on the land, including income received from hunt ing or recreational leases.

On or after Jan. 1, 2008, an individual is not entitled to have land designated for agricultural use if the land secures a home equity loan described by Article

XVI, Section 50(a)(6), Texas Constitution.

If you have questions on completing this application or on the information concerning additional taxes and penalties created by a change of use of the land,

you may consult the State Comptroller’s Manual for the Appraisal of Agricultural Land and your appraisal district staff. The manual may be found on the

Comptroller’s Web site at under the section concerning appraisal manuals.

You must complete this application in full and file it with the chief appraiser before May 1 of the year you are applying for agricultural appraisal. To be

accepted, this form must contain information necessary to determine the validity of the claim. If your appli cation is approved, you do not need to file again

in later years unless the chief appraiser requests a new application. The chief appraiser may disapprove the application and request additional information.

The chief appraiser may deny the application and you may protest that determination to the county appraisal review board in a timely manner. If the chief

appraiser requests additional information from an applicant, the information must be furnished within 30 days after the date of the request, or the application

is denied. For good cause shown, the chief appraiser may extend the deadline for furnishing the information by written order for a single 15 day period.

You may file a late application up to midnight the day before the appraisal review board approves appraisal records for the year which usually occurs in

July. If you file a late application and your application is approved, you must pay a penalty equal to 10 percent of the difference between the amount of tax

imposed on the property and the amount that would be imposed if the property were taxed at market value.

OTHER IMPORTANT INFORMATION

If the initial application form does not contain all the information needed to determine whether property qualifies, the chief appraiser may request additional

information. The chief appraiser may request only additional information that is necessary to determine whether the land qualifies for 1-d-1 appraisal.

You must notify the chief appraiser in writing if you: stop using your property for agriculture (e.g., you voluntarily decide to stop farming); change the

category of your use (e.g., you change from dry cropland to irrigated cropland); change the level of your use (e.g., you substan tially increase or decrease

the number of cattle you raise); change the nature of your use (e.g., you switch from growing corn to growing ornamental plants); enter, leave or change

governmental programs (e.g., you put 100 acres in Conservation Reserve Program); or if you begin using your land for something other than agriculture

(e.g., you build a shopping center on most of your land). You must deliver this notice no later than the April 30 following the change in use or eligibility.

PENALTIES

If your land receives agricultural appraisal and you fail to notify the chief appraiser of a change in agricultural use, you may be required to pay a penalty. You

will be required to pay a substantial additional tax plus interest (a “rollback” tax) if you stop using all or part of the property for agriculture.

STEP 1: State the Year for Which You are Seeking Agricultural Use Appraisal

_____________________________________

State the year for which you are seeking agricultural use appraisal

STEP 2: Provide Name and Mailing Address of Property Owner

___________________________________________________________________________________________________

Name of Property Owner

___________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-129 • 05-12/12

1

1 2

2 3

3 4

4 5

5