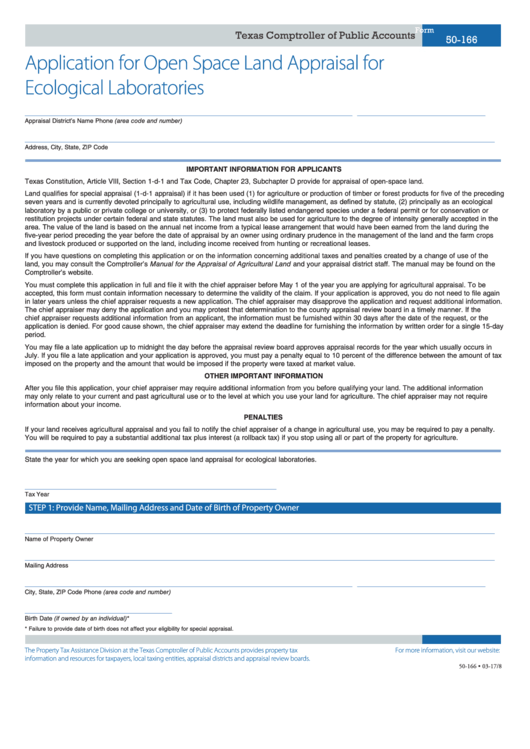

Form

Texas Comptroller of Public Accounts

50-166

Application for Open Space Land Appraisal for

Ecological Laboratories

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

IMPORTANT INFORMATION FOR APPLICANTS

Texas Constitution, Article VIII, Section 1-d-1 and Tax Code, Chapter 23, Subchapter D provide for appraisal of open-space land.

Land qualifies for special appraisal (1-d-1 appraisal) if it has been used (1) for agriculture or production of timber or forest products for five of the preceding

seven years and is currently devoted principally to agricultural use, including wildlife management, as defined by statute, (2) principally as an ecological

laboratory by a public or private college or university, or (3) to protect federally listed endangered species under a federal permit or for conservation or

restitution projects under certain federal and state statutes. The land must also be used for agriculture to the degree of intensity generally accepted in the

area. The value of the land is based on the annual net income from a typical lease arrangement that would have been earned from the land during the

five-year period preceding the year before the date of appraisal by an owner using ordinary prudence in the management of the land and the farm crops

and livestock produced or supported on the land, including income received from hunting or recreational leases.

If you have questions on completing this application or on the information concerning additional taxes and penalties created by a change of use of the

land, you may consult the Comptroller’s Manual for the Appraisal of Agricultural Land and your appraisal district staff. The manual may be found on the

Comptroller’s website.

You must complete this application in full and file it with the chief appraiser before May 1 of the year you are applying for agricultural appraisal. To be

accepted, this form must contain information necessary to determine the validity of the claim. If your application is approved, you do not need to file again

in later years unless the chief appraiser requests a new application. The chief appraiser may disapprove the application and request additional information.

The chief appraiser may deny the application and you may protest that determination to the county appraisal review board in a timely manner. If the

chief appraiser requests additional information from an applicant, the information must be furnished within 30 days after the date of the request, or the

application is denied. For good cause shown, the chief appraiser may extend the deadline for furnishing the information by written order for a single 15-day

period.

You may file a late application up to midnight the day before the appraisal review board approves appraisal records for the year which usually occurs in

July. If you file a late application and your application is approved, you must pay a penalty equal to 10 percent of the difference between the amount of tax

imposed on the property and the amount that would be imposed if the property were taxed at market value.

OTHER IMPORTANT INFORMATION

After you file this application, your chief appraiser may require additional information from you before qualifying your land. The additional information

may only relate to your current and past agricultural use or to the level at which you use your land for agriculture. The chief appraiser may not require

information about your income.

PENALTIES

If your land receives agricultural appraisal and you fail to notify the chief appraiser of a change in agricultural use, you may be required to pay a penalty.

You will be required to pay a substantial additional tax plus interest (a rollback tax) if you stop using all or part of the property for agriculture.

State the year for which you are seeking open space land appraisal for ecological laboratories.

_____________________________________________________

Tax Year

STEP 1: Provide Name, Mailing Address and Date of Birth of Property Owner

___________________________________________________________________________________________________

Name of Property Owner

___________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

_______________________________

Birth Date (if owned by an individual)*

* Failure to provide date of birth does not affect your eligibility for special appraisal.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-166 • 03-17/8

1

1 2

2