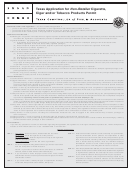

AP-175-2

PRINT FORM

CLEAR FORM

(Rev.8-11/13)

Texas Application for Non-Retailer

Cigarette, Cigar and/or

• Type or print.

• Do NOT write in shaded areas.

Tobacco Products Permit

Page 1

NOTE: Where space indicators are shown, enter only one letter or number in each space and skip one space between words.

•

¿Si necesita informacion sobre impuestos prefiere usted hablar con una persona que habla español? .............................................

Si

No

1. Legal name of owner (sole owner or partners, first name, middle initial and last name; corporation or other name)

•

2. Mailing address (street and number, P.O. Box or rural route and box number)

•

City

State

ZIP code

County

•

•

•

Area code

Number

3. Enter the daytime phone number of the person

•

(

)

primarily responsible for filing tax returns. ...................................................................................

4. Enter your Federal Employer Identification (FEI) Number, if any,

1

assigned by the United States Internal Revenue Service. ..........................................................

3

5. If you are incorporating an existing business,

enter the taxpayer number of the existing business. .........................................................................

6. Enter your taxpayer number for reporting any Texas tax OR your Texas vendor

identification number if you now have or have ever had one. ...........................................................

7. Indicate how your business is owned.

1 - Sole owner

2 - Partnership

3 - Texas corporation

7 - Limited partnership

6 - Foreign corporation

4 - Other (explain)

Charter number

Charter date (month, day, year)

8. If your business is a Texas corporation,

enter the charter number and date. ............................................................

9. If your business is a foreign corporation, enter home state, charter number, Texas Certificate of Authority number and date.

Home state

Charter number

Texas Cert. of Auth. No.

Cert. of Auth. date (month, day, year)

Home state

Identification number

10. If your business is a limited partnership,

enter the home state and identification number .....................................................

11. Complete for sole owners, general partners or principal officers of your business. (Attach additional sheets, or complete Form 69-209, if necessary.)

Name (first, middle initial, last)

•

Social Security or Federal Employer Identification (FEI) no.

Driver license number

State

Phone (area code and number)

(

)

•

Home address (street and number, city, state, ZIP code)

Sex .....

M

F

Date of birth (month, day, year)

Race

Percent of ownership or

Has this person ever been convicted

%

Corporate stock held ...

of a felony in any state? .....

YES

NO

Position (Check all applicable boxes.)

Sole owner

Partner

Director

Officer

Corporate stockholder

Other (specify)

Name (first, middle initial, last)

•

Social Security or Federal Employer Identification (FEI) no.

Driver license number

State

Phone (area code and number)

(

)

•

Home address (street and number, city, state, ZIP code)

Sex .....

M

F

Date of birth (month, day, year)

Race

Percent of ownership or

Has this person ever been convicted

%

Corporate stock held ...

of a felony in any state? .....

YES

NO

Position (Check all applicable boxes.)

Sole owner

Partner

Director

Officer

Corporate stockholder

Other (specify)

Federal Privacy Act

Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected

by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public information

request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in

accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone number

listed on this form.

1

1 2

2 3

3 4

4