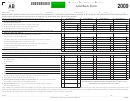

Schedule Three: Establishing Expenses Qualify for Exception Three

1. Related Member _____________________________________________________________________

2

2. Expense Amount Not Added Back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Attach a statement describing taxpayer circumstances that make the adjustments unreasonable.

Instructions

Establishment of Qualification for 40-18-35(b) Exception

Pursuant to Ala. Code §40-18-35(b) and Regulation 810-3-35-.02, related member interest and/or intangible expenses must be added

back to the taxpayer’s apportionable income unless the taxpayer “shows” or “establishes” that it satisfies an exception described in §40-

18-35(b) and Reg. 810-3-35-.02. If the taxpayer incurred related member intangible and/or interest expenses that were not added back

to apportionable income on its Alabama corporate income tax return, it must establish that it satisfies an exception. The possible excep-

tions are listed below:

Exception One – The related member’s corresponding item of income was, post-allocation and apportionment, subject to a tax on

net income in Alabama or another state or a foreign nation (of which the related member is a resident) which has in force an income

tax treaty with the United States.

Exception Two – The recipient related member is a) not primarily engaged in the acquisition, use, licensing, etc. of intangible prop-

erty or the financing of related entities and b) the underlying transaction(s) giving rise to the related member intangible/interest

expenses did not have as a principal business purpose the avoidance of Alabama tax.

Exception Three – The add-back adjustments are unreasonable.

Exception One

To verify that the related member intangible/interest expense qualifies for Exception One, provide the following:

a. the recipient related member’s name,

b. the amount of expense paid the recipient related member but not added back,

c. the recipient related member’s federal taxable income,

d. the jurisdictions where the recipient related member filed income tax returns that included the corresponding item of income,

e. the recipient related member’s apportionment percentage to each such jurisdiction where the corresponding item of income

was included in apportionable income, or the amount of the corresponding item of income allocated to any jurisdiction requir-

ing the allocation of such income.

Provide this information as indicated in Schedule One. Separate related members will require separate schedules.

Exception Two

To establish that related member intangible/interest expenses qualify for Exception Two, provide the following:

a. the recipient related member’s name,

b. the recipient related member’s total receipts,

c. the recipient related member’s receipts organized by category including receipts from intangible or financing activities, and

d. the statement provided in Schedule Two, signed by an informed corporate officer.

Provide this information as indicated in Schedule Two. Separate related members will require separate schedules.

Exception Three

To establish that related member intangible/interest expenses qualify for Exception Three, provide a detailed statement describing

the circumstances particular to the taxpayer that make the adjustment unreasonable and attach to this form.

Provide this information as indicated in Schedule Three. Separate related members will require separate schedules.

1

1 2

2