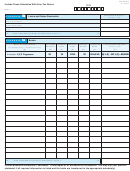

Please Enter Your Federal Employer’s Identification

Number

Here...

Balance Sheet

as of the Last Income Tax Year Ended

Column A

Column B

Column C

Liabilities and

Assets

Total Everywhere as per

Total in Oklahoma

Total Everywhere as per

Stockholders’

Books of Account.

as per Books

Books of Account.

If all Property is in

of Account.

Equity

Oklahoma,

Do Not Use this Column.

1. Cash .......................................

19. Accounts payable ....................

2. Notes and accounts receiveable

20. Accrued payables ....................

3. Inventories ..............................

21. Indebtedness payable

three years or less after

4. Government obligations and

issuance

other bonds............................

(see schedule D) .....................

5. Other current assets

22. Other current liabilities .............

(please attach schedule) ........

23. Total Current Liabilities .........

6. Total Current Assets

(Lines: 19-22)

(add lines 1A-5A and 1B-5B) .

24. Inter-company payables

7. Mortgage and real estate loans

(a) To parent company .............

8. Other investments

(b) To subsidiary company .......

(please attach schedule) ........

(c) To affiliated company ..........

9. (a) Building .............................

25. Indebtedness maturing and

(b) Less accumulated

payable in more than three

depreciation ........................

years from the date of issuance

10. (a) Fixed depreciable assets .

26. Loans from stockholders not

(b) Less accumulated

payable within three years .......

depreciation .......................

27. Other liabilities .........................

11. (a) Depletable assets .............

28. Capital Stock

(b) Less accumulated

(a) Preferred stock ....................

depletion ............................

(b) Common Stock....................

12. Land......................................

29. Paid-in or capital surplus

13. (a) Intangible assets .............

(attach reconciliation) ...............

(b) Less accumulated

30. Retained earnings ...................

amortization ......................

31. Other capital accounts .............

14. Other assets .........................

32. Total Liabilities and

15. Net Assets ...........................

Stockholders’ Equity .............

(Lines: 6-14)

(Lines: 23-31)

16. Inter-company receivables:

33. Total gross business done

(a) From parent company .....

everywhere

(b) From subsidiary company

(sales and service) ................

(c) From affiliated company .

(from income tax return)

17. Bank holding company

34. Total gross business

stock in subsidiary bank .......

done in Oklahoma

(sales and service) ................

18. TOTAL ASSETS ...................

(from income tax return)

(Lines: 15-17)

1

1 2

2