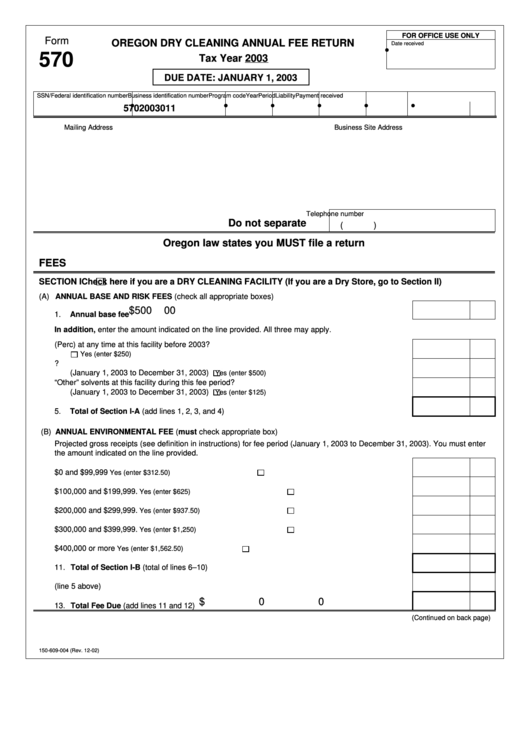

Form 570 Oregon Dry Cleaning Annual Fee Return 2003

ADVERTISEMENT

FOR OFFICE USE ONLY

Form

OREGON DRY CLEANING ANNUAL FEE RETURN

Date received

•

570

Tax Year 2003

DUE DATE: JANUARY 1, 2003

SSN/Federal identification number

Business identification number

Program code

Year

Period

Liability

Payment received

•

•

•

•

•

•

570

2003

01

1

Mailing Address

Business Site Address

Telephone number

Do not separate

(

)

Oregon law states you MUST file a return

FEES

SECTION I

Check here if you are a DRY CLEANING FACILITY (If you are a Dry Store, go to Section II)

(A) ANNUAL BASE AND RISK FEES (check all appropriate boxes)

$500

00

1.

Annual base fee ................................................................................................................................... 1

In addition, enter the amount indicated on the line provided. All three may apply.

2.

Did you use Perchloroethylene (Perc) at any time at this facility before 2003?

.................................................................................................................................. 2

Yes (enter $250)

3.

Will you use Perc at this facility during this fee period?

(January 1, 2003 to December 31, 2003)

............................................................. 3

Yes (enter $500)

4.

Will you use any “Other” solvents at this facility during this fee period?

(January 1, 2003 to December 31, 2003)

............................................................. 4

Yes (enter $125)

5.

Total of Section I-A (add lines 1, 2, 3, and 4)..................................................................................... 5

(B) ANNUAL ENVIRONMENTAL FEE (must check appropriate box)

Projected gross receipts (see definition in instructions) for fee period (January 1, 2003 to December 31, 2003). You must enter

the amount indicated on the line provided.

6.

Facilities with gross receipts between $0 and $99,999

.................................... 6

Yes (enter $312.50)

7.

Facilities with gross receipts between $100,000 and $199,999.

.......................... 7

Yes (enter $625)

8.

Facilities with gross receipts between $200,000 and $299,999.

..................... 8

Yes (enter $937.50)

9.

Facilities with gross receipts between $300,000 and $399,999.

....................... 9

Yes (enter $1,250)

10. Facilities with gross receipts of $400,000 or more

...................................... 10

Yes (enter $1,562.50)

11. Total of Section I-B (total of lines 6–10) ........................................................................................... 11

12. Total from Section I-A (line 5 above) .................................................................................................. 12

$

00

13. Total Fee Due (add lines 11 and 12) ................................................................................................. 13

(Continued on back page)

150-609-004 (Rev. 12-02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2