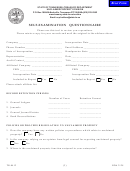

INSTRUCTIONS

In answer to Question No. 6 please check via;( ), in the space provided via, ( ), the uses of gasoline or diesel for which you will

claim a refund of the Motor Fuel Tax. THIS LIST INCLUDES ALL THOSE USES SUBJECT TO A REFUND.

(a) (Deleted by amendment)

(b) Autobuses while being operated over the highways of this State in those municipalities to which the operator has paid

a monthly franchise tax for the use of the streets therein under the provisions of R. S. 48:16-25, and autobuses while

being operated over the highways of this state in a regular route bus operation as defined in R. S. 48:4-1, and under

operating authority conferred pursuant to R. S. 48:4-3, or while providing bus service under a contract with the New

Jersey Transit Corporation or under a contract with a county for special or rural transportation bus service subject to the

jurisdiction of the New Jersey Transit Corporation pursuant to P. L. 1979, C. 150, and autobuses providing commuter

bus service which receive or discharge passengers in New Jersey.

(c) Agricultural tractors not operated on a public highway,

(d) farm machinery,

(e) aircraft.,

(f) ambulances,

(g) rural free delivery carriers in the dispatch of their official business,

(h) such vehicles as run only on rails or tracks, and such vehicles as run in substitution thereof,

(i) such highway motor vehicles as are operated exclusively on private property,

(j) motor boats or motor vessels used exclusively for or in the propagation, planting, preservation and gathering of

oysters and clams in tidal waters of the State,

(k) motor boats or motor vessels used exclusively for commercial fishing,

(l) motor boats or motor vessels while being used for hire for fishing parties, or being used for sightseeing or excursion

parties,

(m) cleaning,

(n) fire engines and fire fighting apparatus,

(o) stationary machinery and vehicles or implements not designed for the use of transporting persons or property on the

public highway,

(p) heating and lighting devices,

(q) fuels previously taxed under this act and later exported or sold for exportation from the State of New Jersey to any

other State or country, provided proof satisfactory to the Commissioner of such exportation is submitted,

(r) motor boats or motor vessels used exclusively for Sea Scout training by a duly chartered unit of the Boy Scouts of

America,

(s) emergency vehicles used exclusively by volunteer first-aid or rescue squads,

(t) diesel fuel as used by passenger automobiles and motor vehicles of less than 5,000 pounds gross weight,

In answer to Question 8 any person using fuels for any of the following purposes will include the information requested under the

particular use; for example:

BUSSES- Terminal points of each route, length of each route, mileage operated in each municipality to which authority has been

conferred pursuant to R. S. 48:4-1 and 48:4-3 and the number of buses operating on each route. Support statement by copy of

schedules and copy of franchise as approved by Public Utility Commission.

RURAL DELIVERY CARRIERS- Post office and R.D. number, number of trips daily, mileage each trip.

In answering Question 9: FISHERMEN will include the length and beam of each boat: CONTRACTORS will include the capacity

of all shovels, dredges and scoops and the tonnage of all licensed and non-licensed trucks. Use and attach an additional sheet if

necessary.

NOTE: Report to this office within 24 hours any addition to, or reduction of, the equipment listed on this questionnaire, or any

other conditions which will change your estimated use of motor fuel subject to refund of the Motor Fuel Tax.

1

1 2

2