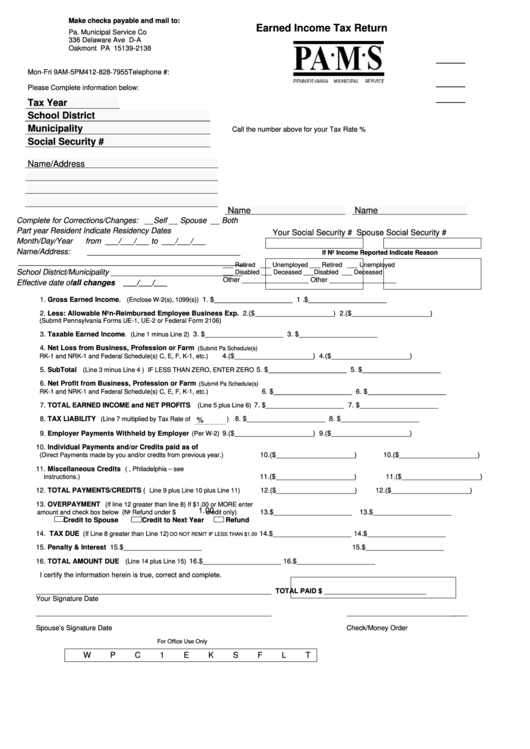

Earned Income Tax Return Form Pennsylvania

ADVERTISEMENT

Make checks payable and mail to:

Earned Income Tax Return

Pa. Municipal Service Co

336 Delaware Ave D-A

Oakmont PA 15139-2138

———————

Mon-Fri 9AM-5PM

Telephone #:

412-828-7955

———————

Please Complete information below:

Tax Year

———————

School District

Municipality

Call the number above for your Tax Rate %

Social Security #

Name/Address

Name

Name

Complete for Corrections/Changes: __Self __ Spouse __ Both

Part year Resident Indicate Residency Dates

Your Social Security #

Spouse Social Security #

Month/Day/Year

from ___/___/___ to ___/___/___

Name/Address:

___________________________________

If No Income Reported Indicate Reason

____________________________________________________

___ Retired ___ Unemployed

___ Retired ___ Unemployed

School District/Municipality ______________________________

___ Disabled ___ Deceased

___Disabled ___ Deceased

Other _________________

Other _________________

Effective date of all changes

___/___/___

1. Gross Earned Income.

(Enclose W-2(s), 1099(s))

1. $____________________

1 .$____________________

2. Less: Allowable Non-Reimbursed Employee Business Exp.

2.($____________________)

2.($____________________)

(Submit Pennsylvania Forms UE-1, UE-2 or Federal Form 2106)

3. Taxable Earned Income.

3. $____________________

3. $____________________

(Line 1 minus Line 2)

4. Net Loss from Business, Profession or Farm

(Submit Pa Schedule(s)

4.($____________________)

4.($____________________)

RK-1 and NRK-1 and Federal Schedule(s) C, E, F, K-1, etc.)

5. SubTotal

(Line 3 minus Line 4 ) IF LESS THAN ZERO, ENTER ZERO

5. $____________________

5. $____________________

6. Net Profit from Business, Profession or Farm

(Submit Pa Schedule(s)

6. $____________________

6. $____________________

RK-1 and NRK-1 and Federal Schedule(s) C, E, F, K-1, etc.)

7. TOTAL EARNED INCOME and NET PROFITS

7. $____________________

7. $____________________

(Line 5 plus Line 6)

8. TAX LIABILITY

(Line 7 multiplied by Tax Rate of

)

8. $____________________

8. $____________________

%

9. Employer Payments Withheld by Employer

9.($____________________)

9.($____________________)

(Per W-2)

10. Individual Payments and/or Credits paid as of

(Direct Payments made by you and/or credits from previous year.)

10.($____________________)

10.($____________________)

11. Miscellaneous Credits

(i.e. Out of State, Philadelphia – see

11.($____________________)

11.($____________________)

instructions.)

12. TOTAL PAYMENTS/CREDITS (

12.($____________________)

12.($____________________)

Line 9 plus Line 10 plus Line 11)

13. OVERPAYMENT

(If line 12 greater than line 8) If $1.00 or MORE enter

1.00

amount and check box below (No Refund under $

credit only)

13.$____________________

13.$____________________

Credit to Spouse

Credit to Next Year

Refund

14. TAX DUE

14.$____________________

14.$____________________

(If Line 8 greater than Line 12)

DO NOT REMIT IF LESS THAN $1.00

15. Penalty & Interest

15.$____________________

15.$____________________

16. TOTAL AMOUNT DUE

(Line 14 plus Line 15)

16.$____________________

16.$____________________

I certify the information herein is true, correct and complete.

____________________________________________________________

TOTAL PAID $ __________________________

Your Signature

Date

____________________________________________________________

____________________________ K/M

Spouse’s Signature

Date

Check/Money Order

For Office Use Only

W

P

C

1

E

K

S

F

L

T

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1