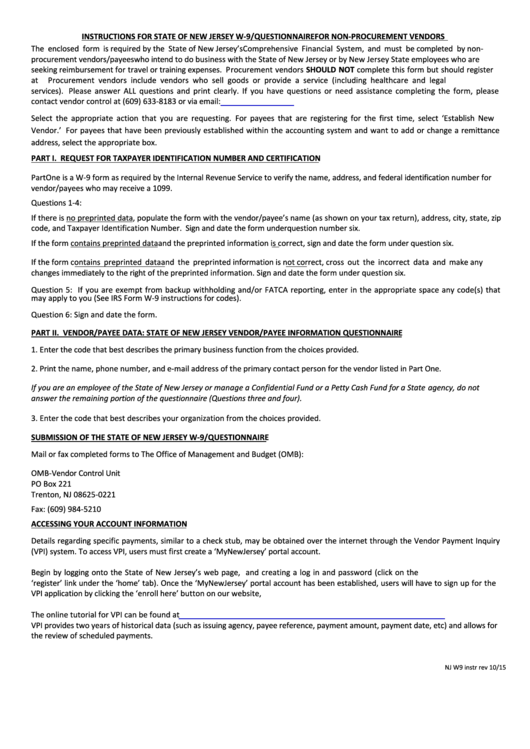

INSTRUCTIONS FOR STATE OF NEW JERSEY W-9/QUESTIONNAIRE FOR NON-PROCUREMENT VENDORS

The enclosed form is required by the State of New Jersey’s Comprehensive Financial System, and must be completed by non-

procurement vendors/payees who intend to do business with the State of New Jersey or by New Jersey State employees who are

seeking reimbursement for travel or training expenses. Procurement vendors SHOULD NOT complete this form but should register

at NJSTART.GOV. Procurement vendors include vendors who sell goods or provide a service (including healthcare and legal

services). Please answer ALL questions and print clearly. If you have questions or need assistance completing the form, please

contact vendor control at (609) 633-8183 or via email:

AAIUNIT@treas.nj.us

Select the appropriate action that you are requesting. For payees that are registering for the first time, select ‘Establish New

Vendor.’ For payees that have been previously established within the accounting system and want to add or change a remittance

address, select the appropriate box.

PART I. REQUEST FOR TAXPAYER IDENTIFICATION NUMBER AND CERTIFICATION

Part One is a W-9 form as required by the Internal Revenue Service to verify the name, address, and federal identification number for

vendor/payees who may receive a 1099.

Questions 1-4:

If there is no preprinted data, populate the form with the vendor/payee’s name (as shown on your tax return), address, city, state, zip

code, and Taxpayer Identification Number. Sign and date the form under question number six.

If the form contains preprinted data and the preprinted information is correct, sign and date the form under question six.

If the form contains preprinted data and the preprinted information is not correct, cross out the incorrect data and make any

changes immediately to the right of the preprinted information. Sign and date the form under question six.

Question 5: If you are exempt from backup withholding and/or FATCA reporting, enter in the appropriate space any code(s) that

may apply to you (See IRS Form W-9 instructions for codes).

Question 6: Sign and date the form.

PART II. VENDOR/PAYEE DATA: STATE OF NEW JERSEY VENDOR/PAYEE INFORMATION QUESTIONNAIRE

1. Enter the code that best describes the primary business function from the choices provided.

2. Print the name, phone number, and e-mail address of the primary contact person for the vendor listed in Part One.

If you are an employee of the State of New Jersey or manage a Confidential Fund or a Petty Cash Fund for a State agency, do not

answer the remaining portion of the questionnaire (Questions three and four).

3. Enter the code that best describes your organization from the choices provided.

SUBMISSION OF THE STATE OF NEW JERSEY W-9/QUESTIONNAIRE

Mail or fax completed forms to The Office of Management and Budget (OMB):

OMB-Vendor Control Unit

PO Box 221

Trenton, NJ 08625-0221

Fax: (609) 984-5210

ACCESSING YOUR ACCOUNT INFORMATION

Details regarding specific payments, similar to a check stub, may be obtained over the internet through the Vendor Payment Inquiry

(VPI) system. To access VPI, users must first create a ‘MyNewJersey’ portal account.

Begin by logging onto the State of New Jersey’s web page,

and creating a log in and password (click on the

‘register’ link under the ‘home’ tab). Once the ‘MyNewJersey’ portal account has been established, users will have to sign up for the

VPI application by clicking the ‘enroll here’ button on our website,

https://www20.state.nj.us/TYM_VPI/

The online tutorial for VPI can be found at

https://www20.state.nj.us/treasury/omb/TYM_VPI/docs/GettingStarted.pdf

VPI provides two years of historical data (such as issuing agency, payee reference, payment amount, payment date, etc) and allows for

the review of scheduled payments.

NJ W9 instr rev 10/15

1

1 2

2