Form De 707e - Worksheet To Telefile A Payroll Tax Deposit

ADVERTISEMENT

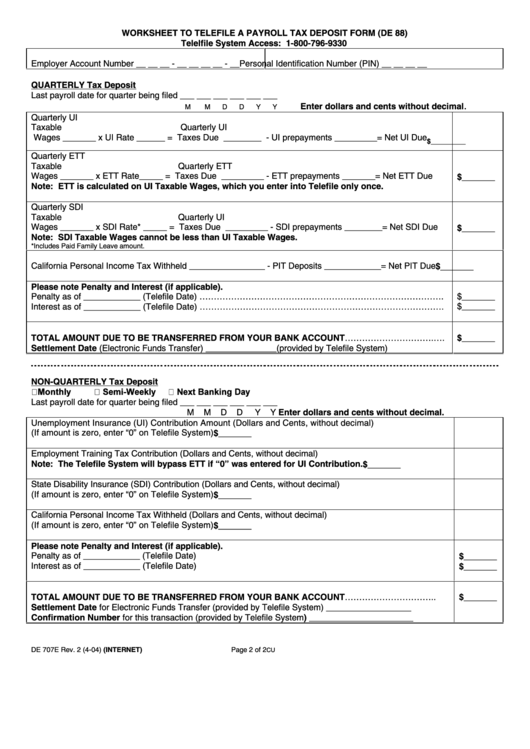

WORKSHEET TO TELEFILE A PAYROLL TAX DEPOSIT FORM (DE 88)

Telelfile System Access: 1-800-796-9330

Employer Account Number __ __ __ - __ __ __ __ - __

Personal Identification Number (PIN) __ __ __ __

QUARTERLY Tax Deposit

Last payroll date for quarter being filed ___ ___ ___ ___ ___ ___

.

Enter dollars and cents without decimal

M

M

D

D

Y

Y

Quarterly UI

Taxable

Quarterly UI

Wages _______ x UI Rate ______ = Taxes Due ________ - UI prepayments _________= Net UI Due

$_________

Quarterly ETT

Taxable

Quarterly ETT

Wages _______ x ETT Rate_____ = Taxes Due _________ - ETT prepayments _______= Net ETT Due

$_______

Note: ETT is calculated on UI Taxable Wages, which you enter into Telefile only once.

Quarterly SDI

Taxable

Quarterly UI

Wages _______ x SDI Rate* _____ = Taxes Due _________ - SDI prepayments ________= Net SDI Due

$_______

Note: SDI Taxable Wages cannot be less than UI Taxable Wages.

*Includes Paid Family Leave amount.

California Personal Income Tax Withheld ________________ - PIT Deposits ____________= Net PIT Due

$_______

Please note Penalty and Interest (if applicable).

Penalty as of ____________ (Telefile Date) ………………………………………………………………………….

$_______

$_______

Interest as of ____________ (Telefile Date) ………………………………………………………………………….

TOTAL AMOUNT DUE TO BE TRANSFERRED FROM YOUR BANK ACCOUNT………………………….….

$_______

Settlement Date (Electronic Funds Transfer) _______________(provided by Telefile System)

NON-QUARTERLY Tax Deposit

0RQWKO\

6HPL:HHNO\

1H[W %DQNLQJ 'D\

Last payroll date for quarter being filed ___ ___ ___ ___ ___ ___

M

M

D

D

Y

Y

Enter dollars and cents without decimal.

Unemployment Insurance (UI) Contribution Amount (Dollars and Cents, without decimal)

(If amount is zero, enter “0” on Telefile System)

$_______

Employment Training Tax Contribution (Dollars and Cents, without decimal)

Note: The Telefile System will bypass ETT if “0” was entered for UI Contribution.

$_______

State Disability Insurance (SDI) Contribution (Dollars and Cents, without decimal)

(If amount is zero, enter “0” on Telefile System)

$_______

California Personal Income Tax Withheld (Dollars and Cents, without decimal)

(If amount is zero, enter “0” on Telefile System)

$_______

Please note Penalty and Interest (if applicable).

Penalty as of ____________ (Telefile Date)

$_______

Interest as of ____________ (Telefile Date)

$_______

TOTAL AMOUNT DUE TO BE TRANSFERRED FROM YOUR BANK ACCOUNT…………………………..

$_______

Settlement Date for Electronic Funds Transfer (provided by Telefile System) __________________

Confirmation Number for this transaction (provided by Telefile System) ______________________

DE 707E Rev. 2 (4-04) (INTERNET)

Page 2 of 2

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1