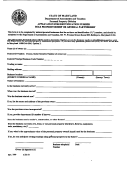

Application For Sales Tax Registration Only For Use By Sole-Proprietorship Owners With No Employees Form Page 2

ADVERTISEMENT

SPECIFIC INSTRUCTIONS

SECTION 1 – TAXPAYER INFORMATION

1. Enter your name as the legal name of the business. Your social security number must be entered in order to process the

application. For a sole proprietorship business only one social security number can be used. Enter the primary address

as the address that you wish to received Maine sales tax-related correspondence. Enter the e-mail address where you

wish to receive Maine sales tax-related e-mail correspondence. List the trade name (or d.b.a.) and the telephone

number of the business. List the physical address of the business location.

2. Provide a brief description of the type of business.

3. Provide the names, EINs, and addresses of other businesses you own, if any.

4. Information on how your business was acquired is required. If you are the originator of the business, check the Start Up

box and you can skip the rest of this question. If you acquired the business, trade or organization or substantially all the

assets of another, who at the time was an employer, you are considered a successor. If you check the “Other” box,

please provide a brief explanation.

SECTION 4A – SALES & USE TAX

5. Enter the date you began (will begin) selling goods or making rentals, providing services or making purchases subject to

Sales/Use Tax. (You must begin filing returns for the period beginning on the date provided here.)

6. A brief description of the type of business you are engaged in.

7. Select the filing frequency that best applies. If your business is open for only part of the year, and you wish to file on a

seasonal basis only, complete only the right column and check the months in which you will be operating. If you select

seasonal, you will be required to file a monthly return for those months for which you are open.

8. Enter the amount of gross sales that you estimate to generate during the next year.

9. If you have 2 or more different geographic locations you must have a separate account number for each location. If you

wish to file a consolidated return for all locations having an account under one social security number check the “yes”

box here.

10. Enter your business address. Sales/use tax returns will be mailed to this address. Complete only if different from the

owner’s address entered in Section 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2