INSTRUCTIONS FOR THE PREPARATION OF FORM CT-12

MULTIPLE RECEIPT/DEDUCTION SCHEDULE

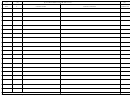

Various purchases and sales of stamped or unstamped cigarettes must be reported on the following schedules:

A. Purchases: Unstamped Cigarettes Imported into Indiana

B. Purchases: Unstamped Cigarettes Purchased in Indiana

C. Purchases: Indiana Stamped Cigarettes

D. Sales: Unstamped Cigarettes Shipped to Another State

E. Sales: Unstamped Cigarettes Sold to Indiana Licensed Distributors

F. Sales: Indiana Stamped Cigarettes Sold to Indiana Licensed Distributors

G. Sales: Indiana Stamped Cigarettes Sold Wholesale and/or Retail

H. Returned to Warehouse: Indiana Stamped Cigarettes Returned to Warehouse

The specific instructions for various schedules must be consulted to determine which is appropriate for a particular type of purchase or sale.

All information for which there is a space provided on the schedule must be completed. However, in lieu of using the standard form available, the Special Tax Division will accept

computer generated printouts, provided that all information required is present.

I. Definitions

Stamped Cigarettes: Any cigarette which has an Indiana cigarette stamp affixed to the original package, regardless if another state’s stamp is also affixed.

Unstamped Cigarettes: Any cigarettes which do not have an Indiana cigarette stamp affixed to the original package; any cigarettes which have another state’s (other than Indiana)

cigarette stamp affixed to the original package; or, any cigarettes which do not have any cigarette stamp affixed to the original package.

II. General Information

A. Indicate the Licensed Cigarette Distributor’s name and license number in the spaces provided.

B. Indicate the period and year for which the schedule is being filed.

C. Indicate the schedule which is being completed by placing an “I” in the appropriate box.

D. Itemize each purchase or sale separately.

E. Group all purchases/sales by suppliers/customers in order of date received/sold.

III. Columnar Information:

(1) Invoice Date: Indicate the date upon which the purchase/sale occurred. This is not necessarily the date upon which the invoice was issued.

(2) Invoice #: Indicate the serial number of the invoice issued by your supplier/you for the cigarettes.

(3) Purchased From/Sold To: Indicate one of the following:

A. Company Name/Address - your supplier’s name and address if you are reporting purchases.

B. Company Name/Address - your customer’s name and address if you are reporting sales.

C. Company Name/Address - the name of the Indiana warehouse and address to which cigarettes were returned.

(4) Number of Cigarettes: Indicate the number of cigarettes purchased, sold or returned to the warehouse.

1

1 2

2 3

3 4

4