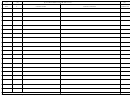

IV. Schedule Information

A. Purchases: Unstamped Cigarettes Imported into Indiana

All unstamped cigarettes purchased from distributor or manufacturer located outside of Indiana and subsequently transported into Indiana for resale or storage are to be indicated

on this schedule.

The total of this schedule is to be transferred to Line #2 of CT-5.

B. Purchases: Unstamped Cigarettes Purchased in Indiana

All unstamped cigarettes purchased in Indiana from a licensed distributor for resale or storage in an Indiana warehouse are to be indicated on this schedule.

The total of this schedule is to be transferred to Line #2 of CT-5.

C. Purchases: Indiana Stamped Cigarettes

All purchases of cigarettes with Indiana cigarette stamps affixed to the original packages are to be indicated on this schedule.

The total of this schedule is to be transferred to Line #6 of CT-24.

D. Sales: Unstamped Cigarettes Shipped to Another State

All unstamped cigarettes which were sold and transported to a destination outside of Indiana are to be reported on this schedule.

Note: The division will allow your company to report a total of the shipments for the month by customer in lieu of itemizing each sale by invoice date and number. However, the

division retains the right to require the distributor to itemize each shipment for export, if a problem arises with the reporting procedures of individual distributors.

The company’s address must indicate the location of the shipment destination instead of the mailing address.

The total of this schedule is to be transferred to Line #5 of the CT-5.

E. Sales: Unstamped Cigarettes Sold to Indiana Licensed Distributors

All unstamped cigarettes sold to Indiana Licensed Cigarette Distributors are to be reported on this schedule. These sales include all shipments made directly from your Indiana

warehouse or from an out-of-state distributor or manufacturer.

The total of this schedule is to be transferred to Line #6 of CT-5.

F. Sales: Indiana Stamped Cigarettes Sold to Indiana Licensed Distributors

Indiana stamped cigarettes sold to Indiana Licensed Cigarette Distributors are to be reported on this schedule.

These sales include all shipments made directly from your Indiana warehouse or from an out-of-state distributor or manufacturer.

The total of this schedule is to be transferred to Line #3 of CT-24 for out-of-state distributors.

Indiana Stamped cigarettes sold to another Indiana Licensed Distributor must be reported on this schedule but the total is not carried forward to Form CT-5.

G. Sales: Indiana Stamped Cigarettes Sold to Wholesalers/Retailers

Indiana stamped cigarettes removed from you warehouse and sold at wholesale or placed in your vending machines are to be reported on this schedule.

The total of this schedule is to be transferred to Line #2 of CT-24.

H. Returned to Warehouse: Indiana Stamped Cigarettes Returned to Warehouse

Indiana stamped cigarettes which were returned to your warehouse and placed in your inventory are to be reported on this schedule.

The total of this schedule is to be transferred to Line #7 of CT-24.

1

1 2

2 3

3 4

4