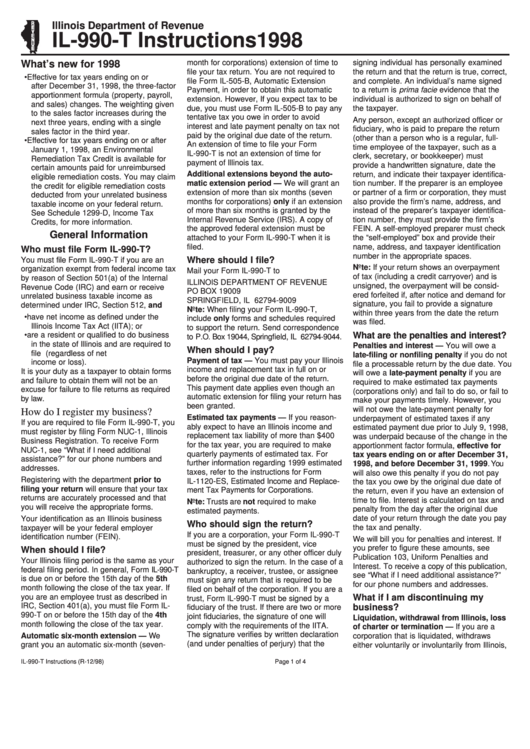

Form Il-990-T Instructions 1998 - Illinois Department Of Revenue

ADVERTISEMENT

Illinois Department of Revenue

IL-990-T Instructions

1998

month for corporations) extension of time to

signing individual has personally examined

What’s new for 1998

file your tax return. You are not required to

the return and that the return is true, correct,

• Effective for tax years ending on or

file Form IL-505-B, Automatic Extension

and complete. An individual’s name signed

after December 31, 1998, the three-factor

to a return is prima facie evidence that the

Payment, in order to obtain this automatic

apportionment formula (property, payroll,

extension. However, If you expect tax to be

individual is authorized to sign on behalf of

and sales) changes. The weighting given

due, you must use Form IL-505-B to pay any

the taxpayer.

to the sales factor increases during the

tentative tax you owe in order to avoid

Any person, except an authorized officer or

next three years, ending with a single

interest and late payment penalty on tax not

fiduciary, who is paid to prepare the return

sales factor in the third year.

paid by the original due date of the return.

(other than a person who is a regular, full-

• Effective for tax years ending on or after

An extension of time to file your Form

time employee of the taxpayer, such as a

January 1, 1998, an Environmental

IL-990-T is not an extension of time for

clerk, secretary, or bookkeeper) must

Remediation Tax Credit is available for

payment of Illinois tax.

provide a handwritten signature, date the

certain amounts paid for unreimbursed

Additional extensions beyond the auto-

return, and indicate their taxpayer identifica-

eligible remediation costs. You may claim

matic extension period — We will grant an

tion number. If the preparer is an employee

the credit for eligible remediation costs

extension of more than six months (seven

or partner of a firm or corporation, they must

deducted from your unrelated business

months for corporations) only if an extension

also provide the firm’s name, address, and

taxable income on your federal return.

of more than six months is granted by the

instead of the preparer’s taxpayer identifica-

See Schedule 1299-D, Income Tax

Internal Revenue Service (IRS). A copy of

tion number, they must provide the firm’s

Credits, for more information.

the approved federal extension must be

FEIN. A self-employed preparer must check

General Information

attached to your Form IL-990-T when it is

the “self-employed” box and provide their

filed.

name, address, and taxpayer identification

Who must file Form IL-990-T?

number in the appropriate spaces.

You must file Form IL-990-T if you are an

Where should I file?

Note: If your return shows an overpayment

organization exempt from federal income tax

Mail your Form IL-990-T to

of tax (including a credit carryover) and is

by reason of Section 501(a) of the Internal

ILLINOIS DEPARTMENT OF REVENUE

unsigned, the overpayment will be consid-

Revenue Code (IRC) and earn or receive

PO BOX 19009

ered forfeited if, after notice and demand for

unrelated business taxable income as

SPRINGFIELD, IL 62794-9009

signature, you fail to provide a signature

determined under IRC, Section 512, and

Note: When filing your Form IL-990-T,

within three years from the date the return

• have net income as defined under the

include only forms and schedules required

was filed.

Illinois Income Tax Act (IITA); or

to support the return. Send correspondence

What are the penalties and interest?

• are a resident or qualified to do business

to P .O. Box 19044, Springfield, IL 62794-9044.

in the state of Illinois and are required to

Penalties and interest — You will owe a

When should I pay?

file U.S. Form 990-T (regardless of net

late-filing or nonfiling penalty if you do not

Payment of tax — You must pay your Illinois

income or loss).

file a processable return by the due date. You

income and replacement tax in full on or

It is your duty as a taxpayer to obtain forms

will owe a late-payment penalty if you are

before the original due date of the return.

and failure to obtain them will not be an

required to make estimated tax payments

This payment date applies even though an

excuse for failure to file returns as required

(corporations only) and fail to do so, or fail to

automatic extension for filing your return has

by law.

make your payments timely. However, you

been granted.

will not owe the late-payment penalty for

How do I register my business?

Estimated tax payments — If you reason-

underpayment of estimated taxes if any

If you are required to file Form IL-990-T, you

ably expect to have an Illinois income and

estimated payment due prior to July 9, 1998,

must register by filing Form NUC-1, Illinois

replacement tax liability of more than $400

was underpaid because of the change in the

Business Registration. To receive Form

for the tax year, you are required to make

apportionment factor formula, effective for

NUC-1, see “What if I need additional

quarterly payments of estimated tax. For

tax years ending on or after December 31,

assistance?” for our phone numbers and

further information regarding 1999 estimated

1998, and before December 31, 1999. You

addresses.

taxes, refer to the instructions for Form

will also owe this penalty if you do not pay

Registering with the department prior to

IL-1120-ES, Estimated Income and Replace-

the tax you owe by the original due date of

filing your return will ensure that your tax

ment Tax Payments for Corporations.

the return, even if you have an extension of

returns are accurately processed and that

time to file. Interest is calculated on tax and

Note: Trusts are not required to make

you will receive the appropriate forms.

penalty from the day after the original due

estimated payments.

Your identification as an Illinois business

date of your return through the date you pay

Who should sign the return?

the tax and penalty.

taxpayer will be your federal employer

If you are a corporation, your Form IL-990-T

identification number (FEIN).

We will bill you for penalties and interest. If

must be signed by the president, vice

you prefer to figure these amounts, see

When should I file?

president, treasurer, or any other officer duly

Publication 103, Uniform Penalties and

Your Illinois filing period is the same as your

authorized to sign the return. In the case of a

Interest. To receive a copy of this publication,

federal filing period. In general, Form IL-990-T

bankruptcy, a receiver, trustee, or assignee

see “What if I need additional assistance?”

is due on or before the 15th day of the 5th

must sign any return that is required to be

for our phone numbers and addresses.

month following the close of the tax year. If

filed on behalf of the corporation. If you are a

you are an employee trust as described in

What if I am discontinuing my

trust, Form IL-990-T must be signed by a

IRC, Section 401(a), you must file Form IL-

business?

fiduciary of the trust. If there are two or more

990-T on or before the 15th day of the 4th

joint fiduciaries, the signature of one will

Liquidation, withdrawal from Illinois, loss

month following the close of the tax year.

comply with the requirements of the IITA.

of charter or termination — If you are a

The signature verifies by written declaration

Automatic six-month extension — We

corporation that is liquidated, withdraws

(and under penalties of perjury) that the

grant you an automatic six-month (seven-

either voluntarily or involuntarily from Illinois,

IL-990-T Instructions (R-12/98)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4