Form W-3 - Withholding Tax Reconciliation

ADVERTISEMENT

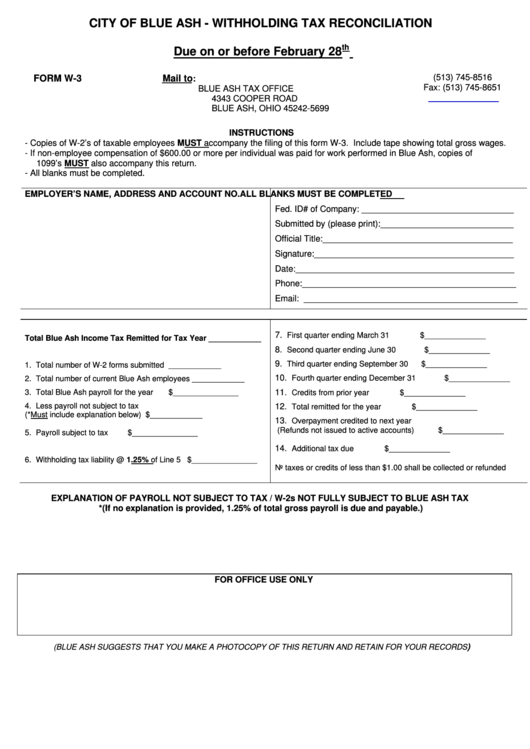

CITY OF BLUE ASH - WITHHOLDING TAX RECONCILIATION

th

Due on or before February 28

(513) 745-8516

FORM W-3

Mail to

:

Fax: (513) 745-8651

BLUE ASH TAX OFFICE

4343 COOPER ROAD

BLUE ASH, OHIO 45242-5699

INSTRUCTIONS

- Copies of W-2’s of taxable employees MUST accompany the filing of this form W-3. Include tape showing total gross wages.

- If non-employee compensation of $600.00 or more per individual was paid for work performed in Blue Ash, copies of

1099’s MUST also accompany this return.

- All blanks must be completed.

EMPLOYER’S NAME, ADDRESS AND ACCOUNT NO.

ALL BLANKS MUST BE COMPLETED

Fed. ID# of Company: ________________________________

Submitted by (please print):____________________________

Official Title:________________________________________

Signature:__________________________________________

Date:______________________________________________

Phone:_____________________________________________

Email: _____________________________________________

7.

First quarter ending March 31

$______________

Total Blue Ash Income Tax Remitted for Tax Year ____________

8.

Second quarter ending June 30

$______________

9.

Third quarter ending September 30

$______________

1.

Total number of W-2 forms submitted

____________

10.

Fourth quarter ending December 31

$______________

2.

Total number of current Blue Ash employees

____________

3.

Total Blue Ash payroll for the year

$_______________

11.

Credits from prior year

$______________

4.

Less payroll not subject to tax

12.

Total remitted for the year

$______________

(*Must include explanation below)

$____________

13.

Overpayment credited to next year

(Refunds not issued to active accounts)

$______________

5.

Payroll subject to tax

$_______________

14.

Additional tax due

$______________

6.

Withholding tax liability @ 1.25% of Line 5 $_______________

No taxes or credits of less than $1.00 shall be collected or refunded

EXPLANATION OF PAYROLL NOT SUBJECT TO TAX / W-2s NOT FULLY SUBJECT TO BLUE ASH TAX

*(If no explanation is provided, 1.25% of total gross payroll is due and payable.)

FOR OFFICE USE ONLY

)

(BLUE ASH SUGGESTS THAT YOU MAKE A PHOTOCOPY OF THIS RETURN AND RETAIN FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1