Form W-3 - Withholding Tax Reconciliation

ADVERTISEMENT

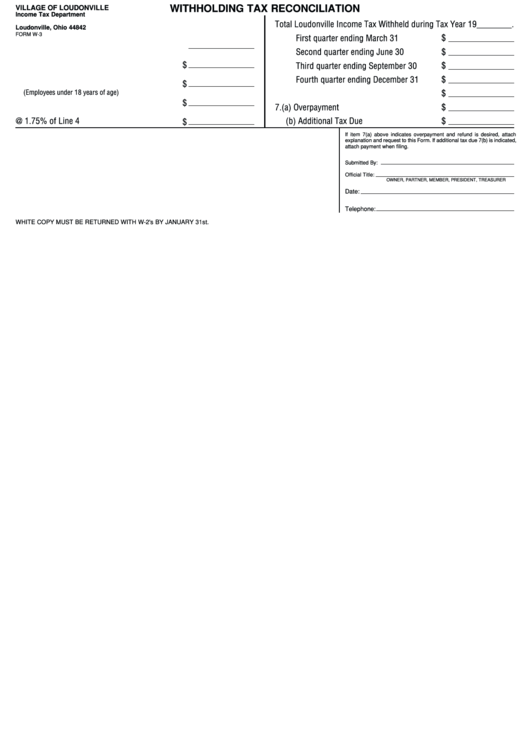

WITHHOLDING TAX RECONCILIATION

VILLAGE OF LOUDONVILLE

Income Tax Department

P.O. Box 115

Total Loudonville Income Tax Withheld during Tax Year 19 ________ .

Loudonville, Ohio 44842

FORM W-3

First quarter ending March 31

$

1. Total number of Loudonville employees

$

Second quarter ending June 30

2. Total Loudonville payroll for the year

$

$

Third quarter ending September 30

Fourth quarter ending December 31

$

3. Less payroll not subject to tax

$

(Employees under 18 years of age)

6. Total remitted for the year

$

4. Payroll subject to tax

$

7. (a) Overpayment

$

5. Withholding tax liability @ 1.75% of Line 4

(b) Additional Tax Due

$

$

If item 7(a) above indicates overpayment and refund is desired, attach

explanation and request to this Form. If additional tax due 7(b) is indicated,

attach payment when filing.

Submitted By:

Official Title:

OWNER, PARTNER, MEMBER, PRESIDENT, TREASURER

Date:

Telephone:

WHITE COPY MUST BE RETURNED WITH W-2's BY JANUARY 31st.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1