Form W-3 - Withholding Tax Reconciliation

ADVERTISEMENT

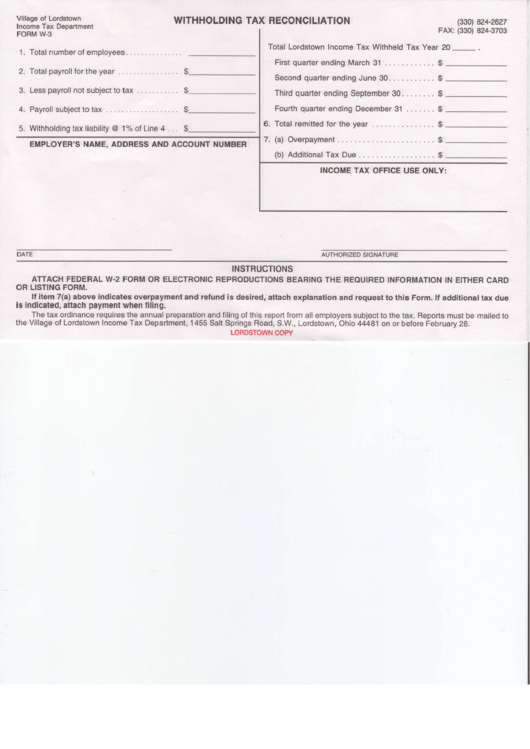

WITHHOLDING TAX RECONCILIATION

(330) 824-2627

FAX: (330) 824-3709

Village of Lordstown

lncome Tax DeDartment

FORM W.3

1. Total number of employees.

2 . T o t a l p a y r o l l f o r t h e y e a r

. .

. . . . . . . $

3. Less payroll not subject to tax . .. .. .. .. . . $

4 . P a y r o l l s u b j e c t t o t a x .

. . . . $

5 . W i t h h o | d i n g t a x | i a b i | i t y @ 1 " / " o | L i n e 4 ' . . $ -

EMPLOYER'S NAME, ADDRESS AND ACCOUNT NUMBER

DATE

Total Lordstown Income Tax Withheld Tax Year 20 _.

F i r s t q u a r t e r e n d i n g M a r c h 3 1

. . . . . . $

Second quarter ending June 30

. . .. . $

Third quarter ending September 30. . . .

Fourth quarter ending December 31 . .

. . $

Total remitted for the year . .

( a ) O v e r p a y m e n t . . .

. . . . . . . . $

( b ) A d d i t i o n a l T a x D u e

. . . . . . $

INCOME TAX OFFICE USE ONLY:

AUTHORIZED SIGNATURE

INSTRUCTIONS

ATTACH FEDERAL W.2 FORM OR ELECTRONIC REPRODUCTIONS

BEARING THE REQUIRED INFORMATION

IN EITHER CARD

OR LISTING FORM.

lf item 7(a) above indicates overpayment and refund is desired, attach explanation and request to this Form. lf additional tax due

is indicated, attach payment when filing.

The tax ordinance requires the annual preparation and filing of this report from all employers subject to the tax. Reports must be mailed to

the Village of Lordstown Income Tax Department, 1455 Salt Springs Road, S.W., Lordstown, Ohio 44481 on or before February 28.

LORDSTOWN COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1