Form Rit-3 - Resource Indemnity Trust Tax Metal Mines 2007

ADVERTISEMENT

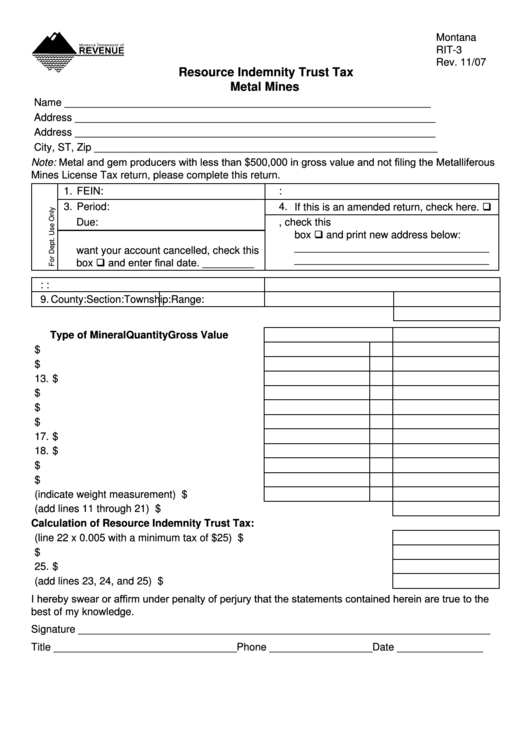

Montana

RIT-3

Rev. 11/07

Resource Indemnity Trust Tax

Metal Mines

Name ________________________________________________________________

Address _______________________________________________________________

Address _______________________________________________________________

City, ST, Zip ____________________________________________________________

Note: Metal and gem producers with less than $500,000 in gross value and not filing the Metalliferous

Mines License Tax return, please complete this return.

1. FEIN:

2. Account ID:

4. If this is an amended return, check here. q

3. Period:

Due:

6. If your address has changed, check this

box q and print new address below:

5. If you are no longer in business and

__________________________________

want your account cancelled, check this

box q and enter final date. _________

__________________________________

7. Mine Operator:

8. Mine Name:

9. County:

Section:

Township:

Range:

10. Tons of ore extracted during production year ..........................................10.

Type of Mineral

Quantity

Gross Value

11. Copper .........................................................11.

oz $

12. Gold ............................................................ 12.

oz $

13. Lead............................................................ 13.

oz $

14. Molybdenum ............................................... 14.

oz $

15. Nickel .......................................................... 15.

oz $

16. Palladium .................................................... 16.

oz $

17. Platinum...................................................... 17.

oz $

18. Silver........................................................... 18.

oz $

19. Zinc ............................................................. 19.

oz $

20. Rhodium ..................................................... 20.

oz $

21. Other (indicate weight measurement) ........ 21.

$

22. Total Gross Value (add lines 11 through 21) ............................................22. $

Calculation of Resource Indemnity Trust Tax:

23. Tax (line 22 x 0.005 with a minimum tax of $25) .....................................23. $

24. Penalties ..................................................................................................24. $

25. Interest.....................................................................................................25. $

26. Total Amount Due (add lines 23, 24, and 25) ..........................................26. $

I hereby swear or affirm under penalty of perjury that the statements contained herein are true to the

best of my knowledge.

Signature ________________________________________________________________________

Title ________________________________Phone __________________ Date _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3