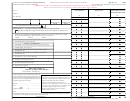

Form Rit-3 - Resource Indemnity Trust Tax Metal Mines 2007 Page 2

ADVERTISEMENT

Montana

RIT-3

Page 2

Resource Indemnity Trust Tax

Metal Mines

(Form RIT-3)

Note: Metal and gem producers with less than $500,000 in gross value and not filing the Metalliferous Mines License Tax

return, please complete this return.

Account Information:

Line 3:

This Report is due on or before March 31st.

Line 4:

If you are filing an amended return, this box must be checked.

Line 5:

If you are no longer in business, enter your final day of business here.

Line 6:

If your mailing address has changed, check the box and provide your new address in the space provided.

Line 7:

Enter the mine operator.

Line 8:

Enter the mine name.

Line 9:

Enter the county where the mine is located and the legal description.

Line 10: Enter the total tons of ore extracted from the mine during the production year.

Total Gross Value:

Line 11: Enter the amount of Copper produced, treated and sold for the year and the amount of total value for the year.

Line 12: Enter the amount of Gold produced, treated and sold for the year and the amount of total value for the year.

Line 13: Enter the amount of Lead produced, treated and sold for the year and the amount of total value for the year.

Line 14: Enter the amount of Molybdenum produced, treated and sold for the year and the amount of total value for the

year.

Line 15: Enter the amount of Nickel produced, treated and sold for the year and the amount of total value for the year.

Line 16: Enter the amount of Palladium produced, treated and sold for the year and the amount of total value for the year.

Line 17: Enter the amount of Platinum produced, treated and sold for the year and the amount of total value for the year.

Line 18: Enter the amount of Silver produced, treated and sold for the year and the amount of total value for the year.

Line 19: Enter the amount of Zinc produced, treated and sold for the year and the amount of total value for the year.

Line 20: Enter the amount of Rhodium produced, treated and sold for the year and the amount of total value for the year.

Line 21: Enter the amount of other metals produced, treated and sold for the year and the amount of total value for the

year.

Line 22: Enter Total Gross Value by adding lines 11 through 21.

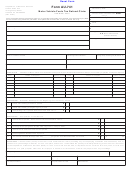

Calculation of Resource Indemnity Trust Tax:

Line 23: Tax Due: multiply line 22 by 0.005 (0.5%), with a minimum tax of $25.00.

Line 24: If payment is delinquent you are subject to penalty of 1.5% per month, not to exceed 18% of the tax due, for tax

periods beginning on or before December 31, 2006. For tax periods beginning after December 31, 2006, the late

payment penalty continues to accrue at 1.2% a month but cannot exceed 12% of the tax due. In addition, a late

filing penalty of $50 or the amount of the tax due, whichever is less, also applies if the return is filed late. Enter

the penalties line 24.

Line 25: If payment is delinquent you are subject to interest of 12% per year, calculated daily, from the original due date

of this report until paid. Enter the interest on line 25.

Line 26: Total Amount Due: add lines 23, 24, and 25. This should be the amount submitted with this return. Please

reference your Account ID from line 2 of the return on the memo line of your check.

Sign the return and provide the title and phone number (where the person signing this return can be reached during

business hours).

Please call (406) 444-6900 if you have any questions regarding the completion of this return.

Make check payable to the Department of Revenue.

Mail this return and payment to:

Department of Revenue, PO Box 5805, Helena MT 59604-5805

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3