Form 12a018 - Kentucky Department Of Revenue Offer In Settlement Application

ADVERTISEMENT

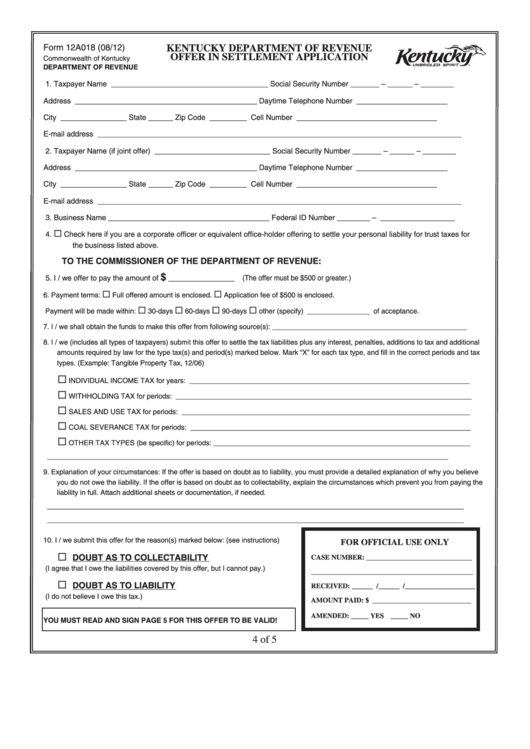

KENTUCKY DEPARTMENT OF REVENUE

Form 12A018 (08/12)

OFFER IN SETTLEMENT APPLICATION

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

1. Taxpayer Name ______________________________________

Social Security Number _______ – ______ – ________

Address ____________________________________________

Daytime Telephone Number ______________________

City ________________ State ______ Zip Code _________

Cell Number __________________________________

E-mail address ________________________________________________________________________________________

2. Taxpayer Name (if joint offer) ____________________________

Social Security Number _______ – ______ – ________

Address ____________________________________________

Daytime Telephone Number ______________________

City ________________ State ______ Zip Code _________

Cell Number __________________________________

E-mail address ________________________________________________________________________________________

3. Business Name _______________________________________

Federal ID Number ________ – __________________

4. ¨ Check here if you are a corporate officer or equivalent office-holder offering to settle your personal liability for trust taxes for

the business listed above.

TO THE COMMISSIONER OF THE DEPARTMENT OF REVENUE:

$

5. I / we offer to pay the amount of

________________ (The offer must be $500 or greater.)

¨

¨

6. Payment terms:

Full offered amount is enclosed.

Application fee of $500 is enclosed.

Payment will be made within:

¨

30-days

¨

60-days

¨

90-days

¨

other (specify) ________________ of acceptance.

7. I / we shall obtain the funds to make this offer from following source(s): __________________________________________________

8. I / we (includes all types of taxpayers) submit this offer to settle the tax liabilities plus any interest, penalties, additions to tax and additional

amounts required by law for the type tax(s) and period(s) marked below. Mark “X” for each tax type, and fill in the correct periods and tax

types. (Example: Tangible Property Tax, 12/06)

¨

INDIVIDUAL INCOME TAX for years: ________________________________________________________________________

¨

WITHHOLDING TAX for periods: ____________________________________________________________________________

¨

SALES AND USE TAX for periods: __________________________________________________________________________

¨

COAL SEVERANCE TAX for periods: ________________________________________________________________________

¨

OTHER TAX TYPES (be specific) for periods: __________________________________________________________________

_______________________________________________________________________________________________________

9. Explanation of your circumstances: If the offer is based on doubt as to liability, you must provide a detailed explanation of why you believe

you do not owe the liability. If the offer is based on doubt as to collectability, explain the circumstances which prevent you from paying the

liability in full. Attach additional sheets or documentation, if needed.

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

10. I / we submit this offer for the reason(s) marked below: (see instructions)

FOR OFFICIAL USE ONLY

¨

DOUBT AS TO COLLECTABILITY

CASE NUMBER: ______________________________

(I agree that I owe the liabilities covered by this offer, but I cannot pay.)

______________________________________________

¨

DOUBT AS TO LIABILITY

RECEIVED: ______ /______ /____________________

(I do not believe I owe this tax.)

AMOUNT PAID: $ ____________________________

AMENDED:

_____ YES _____ NO

YOU MUST READ AND SIGN PAGE 5 FOR THIS OFFER TO BE VALID!

4 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2