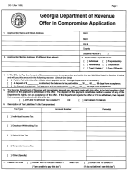

Form 12a018 - Kentucky Department Of Revenue Offer In Settlement Application Page 2

ADVERTISEMENT

Form 12A018 (08/12)

KENTUCKY DEPARTMENT OF REVENUE

Commonwealth of Kentucky

OFFER IN SETTLEMENT APPLICATION

DEPARTMENT OF REVENUE

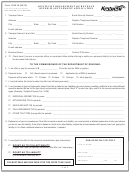

11. TERMS AND CONDITIONS: By submitting this offer, I / we have read, understand and agree to the following:

a.

I / we voluntarily submit all payments made on this offer to the Department of Revenue (DOR).

b.

The DOR will apply payments made under the terms of this offer in the best interest of the Commonwealth.

c.

If the DOR rejects the offer or I / we withdraw the offer, the DOR will not refund any amount paid with offer. The date the offer was made will be

considered the date of payment.

d.

I / we will comply with all Kentucky Revised Statutes and Administrative Regulations relating to filing my / our returns and paying my / our

required taxes for five years from the date the DOR accepts the offer.

e.

I / we waive and agree to the suspension of any statutory period of limitation (time limits provided for by law) for DOR assessment and collection of

the tax liability for the tax periods checked in Item 8.

f.

The DOR will keep all payments and credits made, received, offset, or otherwise applied to the amount being settled before this offer was submitted.

The DOR will also keep any payments made under the terms of an installment agreement and / or offset from any source while this offer is

pending.

g.

The DOR will keep any refund, including interest, due to me / us because of overpayment of any tax or other liability, for tax periods

extending through the calendar year that the offer is paid. For the same period of time, if any part of the tax liability covered by this offer

is for individual income tax or withholding tax, any federal income tax refund that may become due may be offset pursuant to 26 USC

§6402(e). These conditions do not apply if the offer is based only on doubt as to liability.

h.

I / we will return to the DOR any refund identified in Item “g” received after submitting this offer. This condition does not apply if the offer is based

only on doubt as to liability.

i.

The total amount DOR can collect under this offer cannot be more than the full amount of the tax liability.

j.

I / we understand that I / we remain responsible for the full amount of the tax liability unless and until DOR accepts the offer in writing and I / we

have met all the terms and conditions of the offer. DOR will not remove the original amount of the tax liability from its records until I / we have met

all the terms and conditions of the offer.

k.

I / we understand that the tax I / we offer to settle is, and will remain, a tax liability until I / we meet all the terms and conditions of this offer. If I /

we file bankruptcy before the terms and conditions of this offer are completed, any claim the DOR files in the bankruptcy proceeding will be a tax

claim.

l.

Once the DOR accepts the offer in writing, I / we have no right to contest, in court or otherwise, the amount of tax liability.

m.

The offer is pending starting with the date an authorized DOR official signs this form and accepts my / our waiver of the statutory period of

limitation. The offer remains pending until an authorized DOR official accepts, rejects or withdraws the offer in writing.

n.

The waiver and suspension of any statutory period of limitation for assessment and collection of the amount of tax liability described in Item 8

continues to apply:

(i)

while the offer is pending (see Item “m” above);

(ii) during the time I/we have not paid all the amount offered;

(iii) during the time I/we have not completed all terms and conditions of the offer; and

(iv) for one additional year beyond the time periods identified in (i), (ii) and (iii) above.

o.

If I / we fail to meet any of the terms and conditions of the offer, the offer is in default, and the DOR may:

(i)

immediately file suit to collect the entire unpaid balance of the offer;

(ii) immediately file suit to collect an amount equal to the original amount of the tax liability as liquidated damages, minus

any payments received under the terms of this offer;

(iii) disregard the amount of the offer and apply all amounts paid under the offer against the original amount of tax liability;

(iv) file suit or levy to collect the original amount of tax liability, without further notice of any kind.

p.

I / we understand and agree that this offer is on behalf of only those taxpayers who sign as taxpayer - proponents in Item 12a or 12b. The Commonwealth

of Kentucky reserves all rights of collection against co-obligors if any (see instructions on page 3).

q.

I/we have remitted the $500 processing fee with this offer. I/we understand this will not be refunded and will be applied to my/our outstanding

liability with the Commonwealth, regardless of acceptance or rejection of offer.

12. MANDATORY SIGNATURE(S): Under penalties of perjury, I declare that I have examined this offer, including accompanying

schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

FOR OFFICIAL USE ONLY

I accept the waiver of the statutory period of limitations for the

_________________________________________________

Department of Revenue as described on Page 2 , Item 11 (e).

a.

Signature of Taxpayer-proponent

Date

_______________________________________________________

Signature of Authorized Department of Revenue Official

_________________________________________________

_______________________________________________________

b.

Signature of Taxpayer-proponent

Date

Title

Date

5 of 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2