Senior Citizen Rent Increase Exemption (Scrie) Disability Rent Increase Exemption (Drie) Transfer Application Form Page 2

ADVERTISEMENT

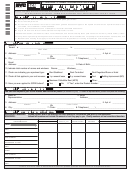

SCRIE < - - > DRIE Transfer Application

Page 2

SECTION 4 - HOUSEHOLD MEMBERS AND INCOME

Please list all household members including yourself and any deceased DRIE or SCRIE beneficiary and their income for the prior calendar year.

HOUSEHOLD

SOCIAL SECURITY

PENSION

WAGES

INTEREST

PUBLIC

OTHER

-

,

,

&

MEMBERS

INCOME

SSA

SSI

SSD

DIVIDENDS

ASSISTANCE

INCOME

SELF

:

NAME

:

DATE OF BIRTH

:

SSN

:

NAME

:

DATE OF BIRTH

:

SSN

If there are more than 3 household members, please provide information on a separate sheet.

SECTION 5 - CERTIFICATION

I hereby affirm under penalties provided by law that I currently reside at this address and have examined this application and the

accompanying documents, and, to the best of my knowledge and belief, the information provided herein is true, correct and complete.

I understand and agree that if I fail to disclose all household income, including income of tenants (family or non-family) or any changes

to the number of household residents, I may be held responsible to repay the City the full amount of any SCRIE or DRIE benefits

received improperly plus any interest charges.

I authorize the release of my information to other agencies for the purpose of determining my eligibility for other entitlements or ben-

efits. I authorize the Department of Finance to review my state and federal income tax returns to verify my income

__________________________________________

________________________________________

_______/_______/_______

Signature of Tenant

Print Name

Date

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether com-

pliance with the request is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for applicants and

income-earning occupants is mandatory and is required by section 11-102.1 of the Administrative Code of the City of New York. Such numbers disclosed on any report or return are

requested for tax administration purposes and will be used to facilitate the processing of reports and to establish and maintain a uniform system for identifying taxpayers who are or

may be subject to taxes administered and collected by the Department of Finance. Such numbers may also be disclosed as part of information contained in the taxpayer’s return to

another department, person, agency or entity as may be required by law, or if the applicant or income-earning occupants gives written authorization to the Department of Finance.

STOP! Final Checklist Before You Mail!

Did you complete all questions on the application, sign and date the application?

n

□ Did you include proof of age such as birth certificate, passport, or other government- issued identification?

□ Did you include a copy of the death certificate for a deceased SCRIE or DRIE beneficiary, if applicable?

□ For Rent Stabilized Apartments: Did you include a copy of your current lease signed by both you and your landlord?

Please note: The lease must clearly state terms of either a one- or a two-year lease.

□ For Rent Controlled Apartments: Did you include a copy of the Notice of Maximum Collectible Rent (MCR Form No.

RN-26) and the Certification of Fuel Cost Adjustment (Form No. RA33.10) for the current year?

□ For Rent Regulated Rooms and hotels: Did you include a copy of a rent increase letter signed by your landlord and a

copy of the DhCR Rent history or DhCR apartment registration?

□ Did you include proof of succession rights such as current, revised lease or rental agreement in your name, letter from

the landlord or court documents stating you have been granted succession rights, if applicable?

□ Did you include proof of income for all household members for the prior calendar year? You must also include the

income for the deceased SCRIE or DRIE beneficiary for the prior calendar year, if applicable.

GENERAL INFORMATION AND ASSISTANCE

If you need help or have questions please contact 311 or visit

nyc.gov/contactscrie

or

nyc.gov/contactdrie

You can visit our SCRIE office at 66 John Street, 3rd floor, New York, NY. We are

open Monday through Friday, between 8:30 AM and 4:30 PM.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2