Multnomah County Business Income Tax Form - 2003 Page 2

ADVERTISEMENT

SOME OF THE INFORMATION PROVIDED ON THIS FORM MAY BE SUBJECT TO DISCLOSURE UNDER PUBLIC RECORD LAW

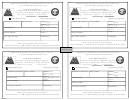

20) If any of the current owners of this business have a current or expired PORTLAND license, give account information:

NAME:

ACCOUNT#:

Year licensed:

21) OWNERS OF CORPORATION OR PARTNERS (List Corporate Owners that hold more than 5% of the voting stock of the

corporation – List all partners, including limited partners, if any) and all LLC members. Use additional sheets if necessary

NAME

ADDRESS, CITY, STATE, ZIP CODE

%

OF

STOCK

Check one

# of

22) ADDRESSES OF RENTAL PROPERTY OWNED: Use additional sheet(s) if necessary.

COMMERCIAL

units

RESIDENTIAL

23) If the business address is on LEASED or RENTED COMMERCIAL PROPERTY, list the name and address of the property

owner below:

PROPERTY OWNER NAME

ADDRESS, CITY, STATE, ZIP CODE

The undersigned declares under penalty of making a false certificate that the information given in this report is true.

Signature of Licensee or Authorized Representative

Title

Date

Payment of the Multnomah County Business Income Tax is required of anyone operating a business in the County

of Multnomah. The tax is 1.45% of the net business income. THERE IS NO MINIMUM TAX. Complete this application

and return it to the Bureau of Licenses. In the first month of your next business year, you will receive a postcard

th

reminder to file a Combined Report form. You will have until the 15

day of the fourth month after your expiration

date to file a Combined Report form and pay the appropriate tax without penalty.

Note: A City of Portland Business License is required of all those doing business within the City of Portland, Oregon.

Exemptions include non-profit agencies and businesses whose total gross receipts for all business everywhere is less than

$25,000 annually. License fees are based upon net income; the minimum annual fee is $100.

Revised 1/03

Notice of Confidentiality: All tax returns, reports and related financial information, including a Taxpayer ID number, filed

2

with the City of Portland are confidential. Except as provided by PCC 7.02.230, .240 and .250, it is unlawful to divulge

or release any financial information submitted or disclosed to the City.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2