Instructions

Reset

Who Must File

Print

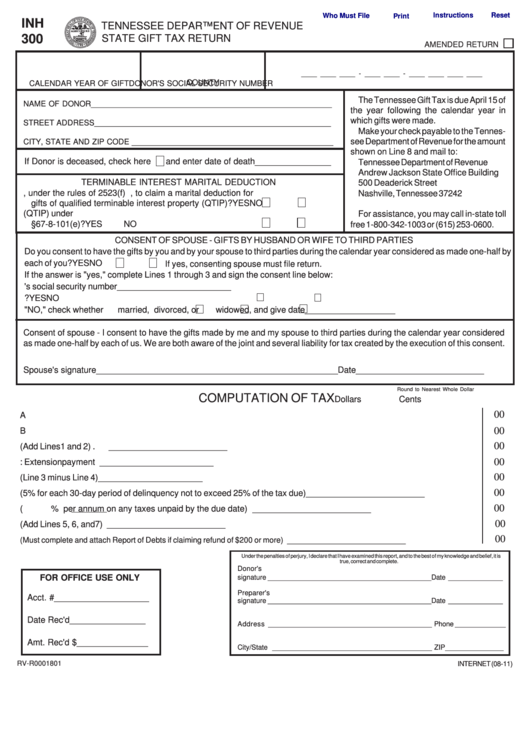

INH

TENNESSEE DEPARTMENT OF REVENUE

300

STATE GIFT TAX RETURN

AMENDED RETURN

____ ____ ____ - ____ ____ - ____ ____ ____ ____

COUNTY

CALENDAR YEAR OF GIFT

DONOR'S SOCIAL SECURITY NUMBER

The Tennessee Gift Tax is due April 15 of

NAME OF DONOR _______________________________________________________

the year following the calendar year in

which gifts were made.

STREET ADDRESS ______________________________________________________

Make your check payable to the Tennes-

see Department of Revenue for the amount

CITY, STATE AND ZIP CODE ______________________________________________

shown on Line 8 and mail to:

If Donor is deceased, check here

and enter date of death ________________

Tennessee Department of Revenue

Andrew Jackson State Office Building

TERMINABLE INTEREST MARITAL DEDUCTION

500 Deaderick Street

1.Do you elect, under the rules of 2523(f) I.R.C., to claim a marital deduction for

Nashville, Tennessee 37242

gifts of qualified terminable interest property (QTIP)? YES

NO

2.Is the gift a disposition of qualified terminable interest property (QTIP) under T.C.A.

For assistance, you may call in-state toll

§67-8-101(e)?

YES

NO

free 1-800-342-1003 or (615) 253-0600.

CONSENT OF SPOUSE - GIFTS BY HUSBAND OR WIFE TO THIRD PARTIES

Do you consent to have the gifts by you and by your spouse to third parties during the calendar year considered as made one-half by

each of you?

YES

NO

If yes, consenting spouse must file return.

If the answer is "yes," complete Lines 1 through 3 and sign the consent line below:

1. Name of spouse __________________________________ Spouse's social security number ________________________

2. Were you married during the entire calendar year?

YES

NO

3. If the answer to 2 is "NO," check whether

married,

divorced, or

widowed, and give date

___________________

Consent of spouse - I consent to have the gifts made by me and my spouse to third parties during the calendar year considered

as made one-half by each of us. We are both aware of the joint and several liability for tax created by the execution of this consent.

Spouse's signature ___________________________________________________ Date ___________________________

Round to Nearest Whole Dollar

COMPUTATION OF TAX

Dollars

Cents

00

1. Total Class A Tax ...................................................................................................................

_________________________

00

2. Total Class B Tax ...................................................................................................................

_________________________

00

3. Total Tax (Add Lines 1 and 2) .................................................................................................

_________________________

00

4. Deduct: Extension payment ...................................................................................................

_________________________

00

5. Net Tax Due (Line 3 minus Line 4) .........................................................................................

_________________________

00

6. Penalty (5% for each 30-day period of delinquency not to exceed 25% of the tax due) ...........

_________________________

00

7. Interest (

% per annum on any taxes unpaid by the due date) ..................................

_________________________

00

8. Total Amount Due (Add Lines 5, 6, and 7) ..............................................................................

_________________________

00

9. Refund Due

_________________________

(Must complete and attach Report of Debts if claiming refund of $200 or more) ................

Under the penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is

true, correct and complete.

Donor's

FOR OFFICE USE ONLY

signature __________________________________________ Date ______________

Preparer's

Acct. # ____________________

signature __________________________________________ Date ______________

Date Rec'd ________________

Address __________________________________________ Phone _____________

Amt. Rec'd $ _______________

City/State _________________________________________ ZIP _______________

RV-R0001801

INTERNET (08-11)

1

1 2

2 3

3 4

4