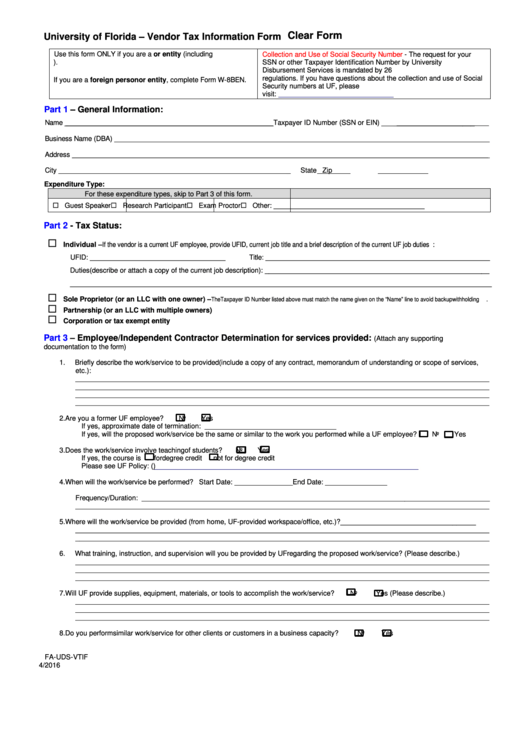

Clear Form

University of Florida – Vendor Tax Information Form

Use this form ONLY if you are a U.S. person or entity (including

Collection and Use of Social Security Number

- The request for your

U.S. resident alien).

SSN or other Taxpayer Identification Number by University

Disbursement Services is mandated by 26 U.S.C. 6041 and related IRS

regulations. If you have questions about the collection and use of Social

If you are a foreign person or entity, complete Form W-8BEN.

Security numbers at UF, please

visit:

Part 1

– General Information:

Name ______________________________________________________

Taxpayer ID Number (SSN or EIN) ________________________

Business Name (DBA) _________________________________________________________________________________________________

Address ____________________________________________________________________________________________________________

City ____________________________________________________________

State

Zip

Expenditure Type:

For these expenditure types, skip to Part 3 of this form.

Guest Speaker

Research Participant

Exam Proctor

Other: _______________________________________

Part 2

- Tax Status:

Individual – If the vendor is a current UF employee, provide UFID, current job title and a brief description of the current UF job duties:

UFID: ___________________________________

Title: __________________________________________________________

Duties (describe or attach a copy of the current job description): __________________________________________________________

_____________________________________________________________________________________________________________

Sole Proprietor (or an LLC with one owner) –

The Taxpayer ID Number listed above must match the name given on the “Name” line to avoid backup withholding.

Partnership (or an LLC with multiple owners)

Corporation or tax exempt entity

Part 3

– Employee/Independent Contractor Determination for services provided:

(Attach any supporting

documentation to the form)

1.

Briefly describe the work/service to be provided (include a copy of any contract, memorandum of understanding or scope of services,

etc.):

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

2.

Are you a former UF employee?

No

Yes

If yes, approximate date of termination: __________________________________

If yes, will the proposed work/service be the same or similar to the work you performed while a UF employee?

No

Yes

3.

Does the work/service involve teaching of students?

No

Yes

If yes, the course is

for degree credit

not for degree credit

Please see UF Policy: ( )

4.

When will the work/service be performed? Start Date: _______________

End Date: ________________

Frequency/Duration: __________________________________________________________________________________________

___________________________________________________________________________________________________________

5.

Where will the work/service be provided (from home, UF-provided workspace/office, etc.)? ___________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

6.

What training, instruction, and supervision will you be provided by UF regarding the proposed work/service? (Please describe.)

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

7.

Will UF provide supplies, equipment, materials, or tools to accomplish the work/service?

No

Yes (Please describe.)

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

8.

Do you perform similar work/service for other clients or customers in a business capacity?

No

Yes

FA-UDS-VTIF

4/2016

1

1 2

2