Form PTAX-341 General Information

What is the Returning Veterans’ Homestead

When will I receive my exemption?

Exemption (RVHE)?

You should apply for this exemption for the assessment year

The Returning Veterans’ Homestead Exemption

(35 ILCS

that you return home. The County Board of Review has the final

provides a $5,000 reduction in the equalized as-

200/15-167)

authority to grant your exemption. If granted, your exemption will

sessed value (EAV) of the veteran’s principal residence for two

be applied to the property tax bills paid the two years following

consecutive assessment (tax) years, the tax year and the follow-

the assessment years.

ing year that the veteran returns from active duty in an armed

conflict involving the armed forces of the United States. The

Can I receive the exemption again?

veteran must own and occupy the property as his or her principal

The exemption applies “only for the tax year and the following tax

residence on January 1 of each assessment year. A veteran who

year in which the veteran returns from active duty in an armed

acquires a principal residence after January 1 of the year he or

conflict involving the armed forces of the U.S.” You may be eli-

she returns home is eligible for the RVHE on the principal resi-

gible for this exemption again if you return home from active duty

dence owned and occupied on January 1 of the next tax year.

in a subsequent year.

Note: For purposes of the exemption, “occupy” means your

principal place of dwelling which is “the place where a person

Do I need to provide documentation?

has his or her true, fixed permanent home and principal

Your Chief County Assessment Officer (CCAO) will require

establishment, and to which, whenever he or she is absent, he

documentation to verify your eligibility for this exemption.

or she has the intention of returning.”

If you were discharged from active duty service, you must provide

Who is eligible?

• the original Form DD 214; or

To qualify for this exemption you must

• a copy of Form DD 214 certified by the county recorder,

• be an Illinois resident who has served as a member of the U.S.

recorder of deed’s, IL Dept. of Veterans’ Affairs, or the National

Armed Forces, Illinois National Guard, or U.S. Reserve Forces,

Archives Record Center.

• have returned from active duty in an armed conflict involving

If you are still on active duty after returning home, you must provide

the armed forces of the U.S.,

• Form DD 220; or

• have owned or had a legal or equitable interest in the land on

• military orders and travel voucher stating that you are returning

which a single-family residence is situated and used as your

from an armed conflict involving the armed forces of the U.S.

principal place of residence on January 1 of the assessment

within the tax year that you returned home.

years, and

When and where must I file Form PTAX-341?

• be liable for the payment of the property taxes.

Note: A representative can apply on behalf of a deceased

You should apply for this exemption for the year when you return

veteran who has met the qualifications listed above.

from active duty in an armed conflict involving the armed forces

of the United States. You must reapply for this exemption if you

Is the resident of a cooperative apartment eligible?

continue to meet the eligibility requirements and change your

To qualify for this exemption, the resident must be

principal residence. Contact your CCAO at the address and

• the owner of record of a legal or equitable interest in the property,

phone number stated below for assistance and the due date for

• occupy it as a principal residence, and

filing for this exemption. Mail your completed Form PTAX-341

• be liable by contract with the owner(s) of record for the property

and supporting documentation to the address below.

t ax payments.

A resident of a cooperative apartment building who has a

leasehold interest does not qualify for this exemption.

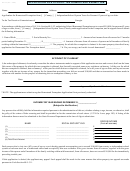

If you have any questions, please call:

Mail your completed Form PTAX-341 to:

618

692-6270

MADISON

(______)___________________________

_____________________ County Chief County Assessment Officer

157 N MAIN ST, Suite 229

______________________________________________________

Mailing address

Edwardsville

62025

_____________________________________ IL ______________

City

ZIP

Official use. Do not write in this space.

___ ___/___ ___/___ ___ ___ ___

___ ___/___ ___/___ ___ ___ ___

Date received

Board of review action date

Month Day Year

Month Day Year

___ ___ ___ ___

Verify proof of eligibility_______________________________

Approved

Denied for

Year veteran returned home

___ ___ ___ ___

Approved

Denied for

Following year

Comments:___________________________________________

Reason for denial: _____________________________________

____________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

PTAX-341 Back (R-12/10)

Reset

Print

1

1 2

2