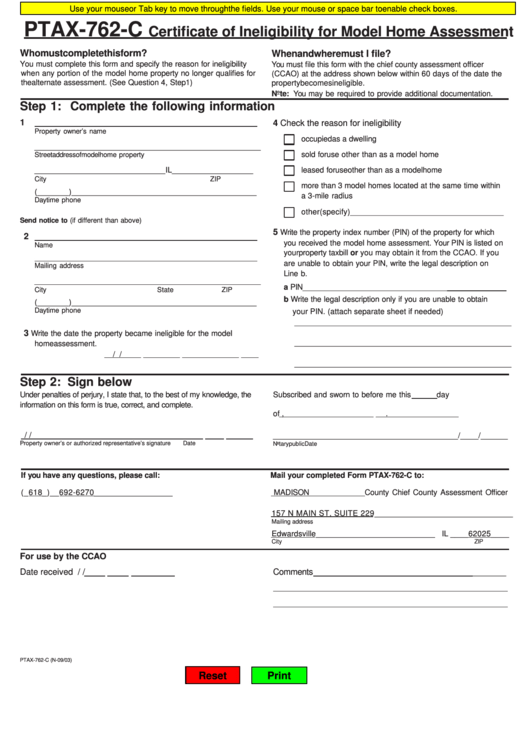

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

PTAX-762-C

Certificate of Ineligibility for Model Home Assessment

Who must complete this form?

When and where must I file?

You must complete this form and specify the reason for ineligibility

You must file this form with the chief county assessment officer

when any portion of the model home property no longer qualifies for

(CCAO) at the address shown below within 60 days of the date the

the alternate assessment. (See Question 4, Step 1)

property becomes ineligible.

Note: You may be required to provide additional documentation.

Step 1: Complete the following information

1

4 Check the reason for ineligibility

Property owner’s name

occupied as a dwelling

_________________________________________________

sold for use other than as a model home

Street address of model home property

_____________________________IL __________________

leased for use other than as a model home

City

ZIP

more than 3 model homes located at the same time within

(_______)_________________________________________

a 3-mile radius

Daytime phone

other (specify)__________________________________

Send notice to (if different than above)

5

Write the property index number (PIN) of the property for which

2

you received the model home assessment. Your PIN is listed on

Name

your property tax bill or you may obtain it from the CCAO. If you

are unable to obtain your PIN, write the legal description on

Mailing address

Line b.

_________________________________________________

a PIN___________________________________

City

State

ZIP

b Write the legal description only if you are unable to obtain

(_______)_________________________________________

Daytime phone

your PIN. (attach separate sheet if needed)

_______________________________________________

3

Write the date the property became ineligible for the model

_______________________________________________

home assessment.

/

/

_______________________________________________

Step 2: Sign below

Under penalties of perjury, I state that, to the best of my knowledge, the

Subscribed and sworn to before me this

day

information on this form is true, correct, and complete.

of

,

.

/

/

_________________________________________/____/______

Property owner’s or authorized representative’s signature

Date

Notary public

Date

If you have any questions, please call:

Mail your completed Form PTAX-762-C to:

(_618_)__692-6270_________________

MADISON

County Chief County Assessment Officer

157 N MAIN ST, SUITE 229______________________________

Mailing address

Edwardsville___________________________ IL ____62025____

City

ZIP

For use by the CCAO

Date received

/

/

Comments

_______

PTAX-762-C (N-09/03)

Reset

Print

1

1