Form Ptax-762 - Application For Model Home Assessment

ADVERTISEMENT

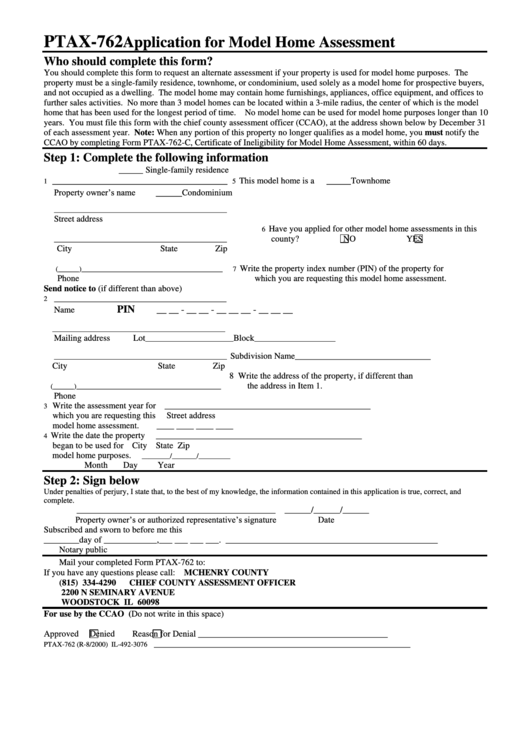

PTAX-762

Application for Model Home Assessment

Who should complete this form?

You should complete this form to request an alternate assessment if your property is used for model home purposes. The

property must be a single-family residence, townhome, or condominium, used solely as a model home for prospective buyers,

and not occupied as a dwelling. The model home may contain home furnishings, appliances, office equipment, and offices to

further sales activities. No more than 3 model homes can be located within a 3-mile radius, the center of which is the model

home that has been used for the longest period of time.

No model home can be used for model home purposes longer than 10

years. You must file this form with the chief county assessment officer (CCAO), at the address shown below by December 31

of each assessment year. Note: When any portion of this property no longer qualifies as a model home, you must notify the

CCAO by completing Form PTAX-762-C, Certificate of Ineligibility for Model Home Assessment, within 60 days.

Step 1:

Complete the following information

_____

Single-family residence

____________________________________

_____

This model home is a

Townhome

1

5

Property owner’s name

_____

Condominium

_________________________________________________

Street address

Have you applied for other model home assessments in this

6

county?

NO

YES

_________________________________________________

City

State

Zip

Write the property index number (PIN) of the property for

(______)________________________________________

7

Phone

which you are requesting this model home assessment.

Send notice to (if different than above)

_______________________________________

2

PIN

__ __ - __ __ - __ __ __ - __ __ __

Name

_________________________________________________

Mailing address

Lot

Block

_________________________

_______________________

Subdivision Name_______________________________

_________________________________________________

City

State

Zip

8 Write the address of the property, if different than

the address in Item 1.

(______)_________________________________________

Phone

Write the assessment year for

_______________________________________________

3

which you are requesting this

Street address

model home assessment.

____ ____ ____ ____

Write the date the property

_______________________________________________

4

began to be used for

City

State

Zip

model home purposes.

________/_______/_________

Month

Day

Year

Step 2:

Sign below

Under penalties of perjury, I state that, to the best of my knowledge, the information contained in this application is true, correct, and

complete.

_____________________________________________ ______/______/______

Property owner’s or authorized representative’s signature

Date

Subscribed and sworn to before me this

________day of ____________,___ ___ ___ ___.

________________________________________________

Notary public

Mail your completed Form PTAX-762 to:

If you have any questions please call:

MCHENRY COUNTY

(815) 334-4290

CHIEF COUNTY ASSESSMENT OFFICER

2200 N SEMINARY AVENUE

WOODSTOCK IL 60098

For use by the CCAO

(Do not write in this space)

Approved

Denied

Reason for Denial ___________________________________________

__________________________________________________________

PTAX-762 (R-8/2000) IL-492-3076

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1