Reset Form

Print Form

DLN (DOR USE ONLY)

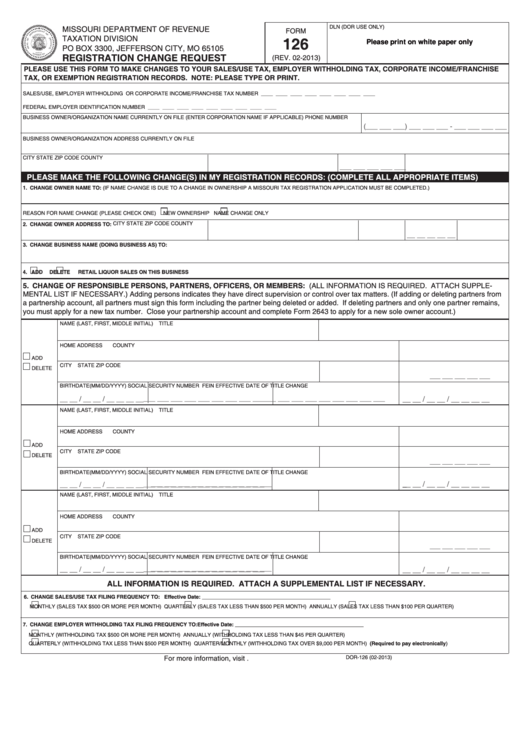

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

126

Please print on white paper only

PO BOX 3300, JEFFERSON CITY, MO 65105

REGISTRATION CHANGE REQUEST

(REV. 02-2013)

PLEASE USE THIS FORM TO MAKE CHANGES TO YOUR SALES/USE TAX, EMPLOYER WITHHOLDING TAX, CORPORATE INCOME/FRANCHISE

TAX, OR EXEMPTION REGISTRATION RECORDS. NOTE: PLEASE TYPE OR PRINT.

SALES/USE, EMPLOYER WITHHOLDING OR CORPORATE INCOME/FRANCHISE TAX NUMBER

____ ____ ____ ____ ____ ____ ____ ____

FEDERAL EMPLOYER IDENTIFICATION NUMBER

____ ____ ____ ____ ____ ____ ____ ____ ____

BUSINESS OWNER/ORGANIZATION NAME CURRENTLY ON FILE (ENTER CORPORATION NAME IF APPLICABLE)

PHONE NUMBER

(___ ___ ___) ___ ___ ___ - ___ ___ ___ ___

BUSINESS OWNER/ORGANIZATION ADDRESS CURRENTLY ON FILE

CITY

STATE

ZIP CODE

COUNTY

___ ___ ___ ___ ___

PLEASE MAKE THE FOLLOWING CHANGE(S) IN MY REGISTRATION RECORDS: (COMPLETE ALL APPROPRIATE ITEMS)

1. CHANGE OWNER NAME TO: (IF NAME CHANGE IS DUE TO A CHANGE IN OWNERSHIP A MISSOURI TAX REGISTRATION APPLICATION MUST BE COMPLETED.)

REASON FOR NAME CHANGE (PLEASE CHECK ONE)

NEW OWNERSHIP

NAME CHANGE ONLY

CITY

STATE

ZIP CODE

COUNTY

2. CHANGE OWNER ADDRESS TO:

__ __ __ __ __

3. CHANGE BUSINESS NAME (DOING BUSINESS AS) TO:

4.

ADD

DELETE RETAIL LIQUOR SALES ON THIS BUSINESS

5. CHANGE OF RESPONSIBLE PERSONS, PARTNERS, OFFICERS, OR MEMBERS: (ALL INFORMATION IS REQUIRED. ATTACH SUPPLE-

MENTAL LIST IF NECESSARY.) Adding persons indicates they have direct supervision or control over tax matters. (If adding or deleting partners from

a partnership account, all partners must sign this form including the partner being deleted or added. If deleting partners and only one partner remains,

you must apply for a new tax number. Close your partnership account and complete Form 2643 to apply for a new sole owner account.)

NAME (LAST, FIRST, MIDDLE INITIAL)

TITLE

HOME ADDRESS

COUNTY

ADD

CITY

STATE

ZIP CODE

DELETE

___ ___ ___ ___ ___

BIRTHDATE(MM/DD/YYYY)

SOCIAL SECURITY NUMBER

FEIN

EFFECTIVE DATE OF TITLE CHANGE

___ ___ ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___ ___ ___ ___ ___

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

NAME (LAST, FIRST, MIDDLE INITIAL)

TITLE

HOME ADDRESS

COUNTY

ADD

CITY

STATE

ZIP CODE

DELETE

___ ___ ___ ___ ___

BIRTHDATE(MM/DD/YYYY)

SOCIAL SECURITY NUMBER

FEIN

EFFECTIVE DATE OF TITLE CHANGE

___ ___ ___ ___ ___ ___ ___ ___ ___

__ __ / __ __ / __ __ __ __

___ ___ ___ ___ ___ ___ ___ ___ ___

__ __ / __ __ / __ __ __ __

NAME (LAST, FIRST, MIDDLE INITIAL)

TITLE

HOME ADDRESS

COUNTY

ADD

CITY

STATE

ZIP CODE

DELETE

___ ___ ___ ___ ___

BIRTHDATE(MM/DD/YYYY)

SOCIAL SECURITY NUMBER

FEIN

EFFECTIVE DATE OF TITLE CHANGE

___ ___ ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___ ___ ___ ___ ___

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

ALL INFORMATION IS REQUIRED. ATTACH A SUPPLEMENTAL LIST IF NECESSARY.

6. CHANGE SALES/USE TAX FILING FREQUENCY TO:

Effective Date: ____________________________________________

MONTHLY (SALES TAX $500 OR MORE PER MONTH)

QUARTERLY (SALES TAX LESS THAN $500 PER MONTH)

ANNUALLY (SALES TAX LESS THAN $100 PER QUARTER)

7. CHANGE EMPLOYER WITHHOLDING TAX FILING FREQUENCY TO:

Effective Date: ____________________________________________

MONTHLY (WITHHOLDING TAX $500 OR MORE PER MONTH)

ANNUALLY (WITHHOLDING TAX LESS THAN $45 PER QUARTER)

QUARTER/MONTHLY (WITHHOLDING TAX OVER $9,000 PER MONTH) (Required to pay electronically)

QUARTERLY (WITHHOLDING TAX LESS THAN $500 PER MONTH)

For more information, visit

DOR-126 (02-2013)

1

1 2

2