Reset Form

Print Form

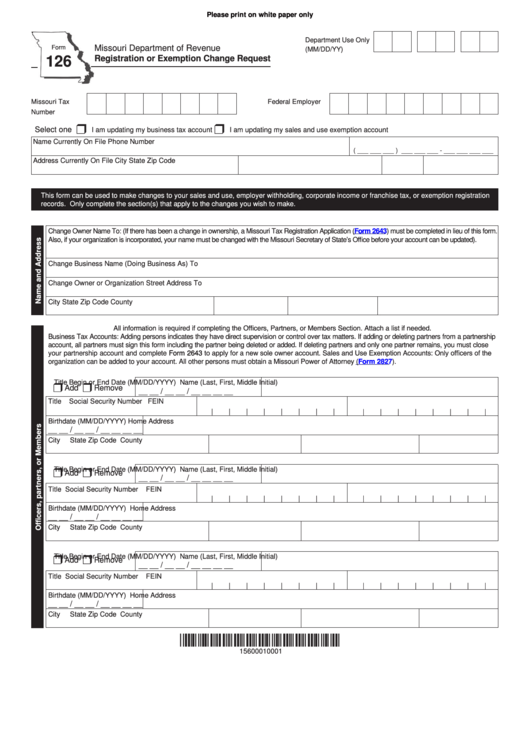

Please print on white paper only

Department Use Only

Form

Missouri Department of Revenue

(MM/DD/YY)

126

Registration or Exemption Change Request

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

r

r

Select one

I am updating my business tax account

I am updating my sales and use exemption account

Name Currently On File

Phone Number

( ___ ___ ___ ) ___ ___ ___ - ___ ___ ___ ___

Address Currently On File

City

State

Zip Code

This form can be used to make changes to your sales and use, employer withholding, corporate income or franchise tax, or exemption registration

records. Only complete the section(s) that apply to the changes you wish to make.

Change Owner Name To: (If there has been a change in ownership, a Missouri Tax Registration Application

(Form

2643) must be completed in lieu of this form.

Also, if your organization is incorporated, your name must be changed with the Missouri Secretary of State’s Office before your account can be updated).

Change Business Name (Doing Business As) To

Change Owner or Organization Street Address To

City

State

Zip Code

County

All information is required if completing the Officers, Partners, or Members Section. Attach a list if needed.

Business Tax Accounts: Adding persons indicates they have direct supervision or control over tax matters. If adding or deleting partners from a partnership

account, all partners must sign this form including the partner being deleted or added. If deleting partners and only one partner remains, you must close

to apply for a new sole owner account. Sales and Use Exemption Accounts: Only officers of the

your partnership account and complete

Form 2643

organization can be added to your account. All other persons must obtain a Missouri Power of Attorney

(Form

2827).

Title Begin or End Date (MM/DD/YYYY) Name (Last, First, Middle Initial)

r

r

Add

Remove

__ __ / __ __ / __ __ __ __

Title

Social Security Number

FEIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birthdate (MM/DD/YYYY)

Home Address

__ __ / __ __ / __ __ __ __

City

State

Zip Code

County

Title Begin or End Date (MM/DD/YYYY) Name (Last, First, Middle Initial)

r

r

Add

Remove

__ __ / __ __ / __ __ __ __

Title

Social Security Number

FEIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birthdate (MM/DD/YYYY)

Home Address

__ __ / __ __ / __ __ __ __

City

State

Zip Code

County

Title Begin or End Date (MM/DD/YYYY) Name (Last, First, Middle Initial)

r

r

Add

Remove

__ __ / __ __ / __ __ __ __

Title

Social Security Number

FEIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birthdate (MM/DD/YYYY)

Home Address

__ __ / __ __ / __ __ __ __

City

State

Zip Code

County

*15600010001*

15600010001

1

1 2

2 3

3